Best ISA rates: last minute deals worth taking up

There is still time to get your ISA up and running before the tax year comes to an end this Sunday

The end of the tax year is nigh. You've only got a few days left to use this year's £15,000 ISA allowance before you lose it forever. If you've been a bit disorganised don't worry, there's still time to get your ISA up and running and shield your savings from the taxman.

Put your money in an ISA and it can grow free from income and capital gains tax. You can invest up to £15,000 this tax year, but if you haven't opened your account and deposited your money before midnight on April 5 you will lose out on this year's allowance.

The good news is that you can open an account just minutes before the midnight deadline so long as you have the information to hand to open the account and are depositing the money online from another bank which processes payments swiftly. But, there's always the chance your internet connection will let you down. So, avoid the stress and get on with your ISA application now.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

To open an ISA you'll need to know the usual personal details – name, address etc – plus your National Insurance number (you can find it on a pay slip or P60) and the account details for the account you're going to deposit the money from.

The best accounts

If you're after an instant-access cash ISA then National Savings & Investments pays 1.5 per cent and you can open the account online or by phone so there's still time. But the account doesn't accept transfers from other ISAs.

Those of you wanting to transfer an ISA to an instant access account will find the best rate is offered by the Post Office at 1.5 per cent. But, this includes a 0.85 per cent bonus for the first 12 months so make sure you shift your money again in a year's time.

Anyone wanting to lock their money away for a while in order to get a better rate should prepare to be disappointed. The rewards for opting for fixed-term bonds are pretty meagre at the moment. The best five-year ISA is offered by Virgin Money with a rate of 2.35 per cent and allows transfers in.

The Coventry offers the best three-year rate at 2.25 per cent but it doesn't allow transfers from other ISAs. If you're looking for a three-year ISA that allows transfers the best on offer is from Chelsea Building Society paying 2.15 per cent.

Check with your bank

This close to the deadline it's also worth checking what rates your own current account provider is offering. Many banks have preferential ISA rates for their own customers and setting up one of these accounts is likely to be quicker as you already have accounts with them.

Santander is offering its 123 current account customers 2 per cent on a two-year fixed ISA and 1.5 per cent on an instant access ISA.

HSBC Premier customers can get an instant access ISA paying 1.6 per cent, while HSBC Advance customers can get a competitive rate of 1.5 per cent plus Save Together, which means you'll get a £10 monthly additional payment into your ISA from HSBC for the first 12 months as long as you deposit either a £300 lump sum or at least £25 a month.

Nationwide is offering an instant access rate of 1.5 per cent to its Flex current account holders.

Not too late to invest

Finally, it isn't too late to open an investment ISA either. So long as the account is open and you've deposited funds before midnight on April 5 it will count as your 2014-15 allowance even if you only deposit cash and sort out what you want to invest in next year.

Several providers including Hargreaves Lansdown, Fidelity and Interactive Investor are geared up and ready to deal with last minute applications.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Ignore the polls. They're stupid.'

'Ignore the polls. They're stupid.'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

The Finest Summer Flavours

The Finest Summer FlavoursBy Sponsored Content Published

-

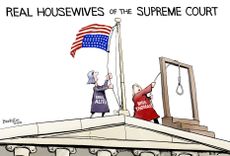

Today's political cartoons - May 20, 2024

Today's political cartoons - May 20, 2024Cartoons Monday's cartoons - flags flipped, Diddy dunked, and more

By The Week US Published