EU to force multinationals to publish tax deals

Commission beefs up previous plans to limit disclosure to national governments

Multinationals will be made to disclose in full their earnings and tax bills in European Union member states in new plans to be brought forward this spring.

Pierre Moscovici, the EU's tax commissioner, has pledged a comprehensive clampdown on companies reducing their tax bills through so-called "sweetheart" deals with national governments. However, last month, the Commission was "heavily criticised" after it proposed only forcing firms to report to the tax authorities in each country on a private basis", says The Guardian.

This followed anger over Google's deal with the UK agreeing to pay £130m to settle ten years' of back-taxes and share awards the company had thought were tax exempt. The European Commission has indicated it may investigate the settlement following a complaint by the Scottish National Party.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Tax has shot up the agenda for Europe's politicians as public unrest grows at the minimal contributions larger companies are making at a time of austerity. Competition commissioner Margrethe Vestager has already ordered Luxembourg, the Netherlands and Belgium to recoup hundreds of millions of pounds from the likes of Starbucks, Fiat and others she says were offered deals so generous as to constitute "state aid".

The EC is also set to rule on the largest case of its type involving Apple in Ireland, which could be worth $8bn (£5.6bn) or even more.

The preponderance of US companies in the crosshairs so far has prompted anger in Washington that its tech giants in particular are being singled out.

But the Guardian says the proposed legislation is designed to target all larger companies that operate across European borders. The plans, which will be presented to politicians on 12 April, are expected to suggest that the full public disclosure requirement is applied to any cross-border business with revenues over a certain level.

The EC has been determined to act a wave since of revelations over how EU taxes were being routinely avoided by funnelling revenues through member state Luxembourg in 2014. Commission President Jean-Claude Juncker is also keen to distance himself from activities that took place while he was finance minister and then prime minister of Luxembourg, between 1995 and 2009.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

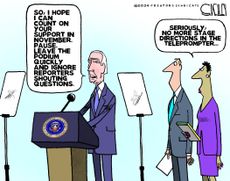

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

Lawmakers say tax prep companies illegally shared taxpayer data with Meta and Google

Lawmakers say tax prep companies illegally shared taxpayer data with Meta and GoogleSpeed Read

By Theara Coleman Published

-

Surviving mid-career job loss

Surviving mid-career job lossfeature And more of the week's best financial insight

By The Week Staff Published

-

How ChatGPT breathed new life into the internet search wars

How ChatGPT breathed new life into the internet search warsSpeed Read The AI arms race is upon us

By Theara Coleman Published

-

Search wars: Google's new challenge from AI

Search wars: Google's new challenge from AIfeature How will Microsoft even things up?

By The Week Staff Published

-

Google didn't believe Bard AI was 'really ready' for a product yet

Google didn't believe Bard AI was 'really ready' for a product yetSpeed Read

By Theara Coleman Published

-

What Big Tech CEOs are saying about their companies' layoffs

What Big Tech CEOs are saying about their companies' layoffsSpeed Read Tech companies are cutting thousands of jobs. Are the top bosses owning up to mistakes or 'sidestepping the blame'?

By Justin Klawans Last updated

-

Troubled union: Apple's China problem

Troubled union: Apple's China problemfeature How will Apple branch away from building products in China?

By The Week Staff Published

-

Elon Musk claims Apple threatened to remove Twitter from the App Store

Elon Musk claims Apple threatened to remove Twitter from the App StoreSpeed Read

By Theara Coleman Published