BP looks to scale back with UK asset sell-off

Oil major to offload its terminals in Belfast, Hamble and Northampton along with stakes in UKOP and Kingsbury

BP has announced plans to sell a range of UK assets and outsource its logistics operations as it continues to scale back its operations after low oil prices and weak profits.

On the block is the company's stake in the United Kingdom Oil Pipeline (UKOP), reports the Daily Telegraph, which connects the Stanlow oil refinery in Cheshire to Heathrow and Gatwick airports. BP co-owns the line with Shell, US firm Valero and French giant Total.

The company is also offloading three wholly-owned storage terminals in Belfast, Hamble and Northampton, as well as its stake in the Kingsbury site that it co-owns with Shell.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Alongside the sell-off, Europe's third largest oil major has struck a deal with logistics firm Hoyer to take over its fuel delivery operations across the UK.

The cost-cutting measures mark the end of a strategic review of BP's European operations.

The company expects at 45 staff at its storage hubs to transfer to new jobs with the new owners, while 280 staff across the delivery operation are thought likely to move over and 30 made redundant.

Oil companies have been under pressure during a two-year price slump that saw international benchmark Brent crude hit a 13-year low of around $27 a barrel in February.

BP reported its biggest-ever annual loss of $6.5bn (£4.9bn) in that month, while profits in the first quarter of this year fell more than 80 per cent to £532m (£403m), notes Reuters. In response, the company cut spending plans three times last year and again in April, to around $17bn (£12.9bn) this year.

Last week, BP announced a further £3.9bn provision in the second quarter would take the total bill relating to the 2010 Deepwater Horizon disaster to $61.6bn (£46.3bn).

A spokesman said: "We regularly carry out strategic reviews of our operations and these decisions ensure that we remain focused on our core activities while our customers benefit from improved efficiency."

BP's bill for Deepwater Horizon spill hits £46bn

15 July

BP has taken another huge charge over the Deepwater Horizon oil spill six years ago, making the total bill for the disaster £46bn.

The company announced yesterday it will take a pre-tax hit of $5.2bn (£3.9bn) in its second quarter results, which are due on 26 July. On an after-tax basis, that translates to a fresh charge of $2.5bn (£1.9bn), reports The Guardian.

The total cost for cleaning up the environmental damage and compensating various national and regional authorities has now hit $61.6bn (£46.3bn).

A blowout on an underwater pipeline caused the destruction of the Deepwater Horizon exploration rig in 2010, with the death of 11 crew members. The well went on to leak for 87 days, the Washington Post reports, and poured more than three million barrels of oil into the Gulf of Mexico.

It was one of the worst environmental disasters ever and led to a spate of lawsuits and fines.

"BP paid all sorts of people, including shrimp fishermen on the Louisiana coast, motels in Mississippi, school districts in Florida and the Environmental Protection Agency, which received $4bn in criminal fines and more than $14bn in Clean Water Act penalties and compensation for natural resource damages," says the Post.

"The cost includes medical costs, property damage, economic losses, its own clean-up costs and a settlement with [financial regulator] the Securities and Exchange Commission."

After this latest charge, any remaining provisions, for example, for lawsuits brought by individuals affected by the disaster, "will not have a material impact on… financial performance", said BP.

Fadel Gheit, an oil analyst at Oppenheimer & Co, said the final estimate of charges was a "really scary number" that was equal to about a third of BP's £135bn market capitalisation before the disaster occurred.

“We’re lucky that BP was not a small company because at the end of the day, the government would have shouldered the entire weight of the accident," he added.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

AI is causing concern among the LGBTQ community

AI is causing concern among the LGBTQ communityIn the Spotlight One critic believes that AI will 'always fail LGBTQ people'

By Justin Klawans, The Week US Published

-

'Modern presidents exercise power undreamed of by the Founding Fathers'

'Modern presidents exercise power undreamed of by the Founding Fathers'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

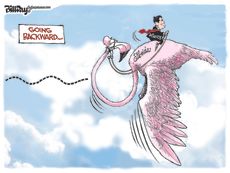

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published