Starbucks suffers reputation slump over tax 'avoidance'

Consumer goodwill drains away over coffee chain's failure to pay tax as more politicians call for boycott

STARBUCKS has suffered serious harm to its reputation over revelations that it pays no corporation tax in the UK, according to pollsters YouGov. The news comes as the coffee shop chain faces calls from MPs for a consumer boycott over its perfectly legal tax affairs.

Reuters reported this week that Starbucks had paid £8.6m in corporation tax since it first opened in the UK in 1998 – and none since 2009. Corporation tax is paid on profits, and Starbucks UK has not reported a profit for the past three years. Despite this, Starbucks officials have regularly described the UK business as "profitable".

YouGov's BrandIndex, a daily measure of brand perception, reveals that Starbucks, which makes much of its ethical corporate policies, has declined markedly in people's estimation, The Guardian reports.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Starbucks' 'buzz' score, which is a measure of the number of negative and positive comments consumers have heard about a brand, has fallen from +0.7 to -13.9 - its lowest in four years. Starbucks' reputation score also dipped: from +4.6 a week ago to -3.9 following the tax revelations.

A BrandIndex spokeswoman said: "To say this story has been a disaster for the Starbucks brand would be a bit of an understatement. It's still too early to say what the long-term impact of this is going to be, but in the current climate we've seen the public take a fairly dim view towards accusations of corporate greed."

Tax campaigner Richard Murphy said of YouGov's findings: "I think the case that tax avoiding can harm shareholder value has been made. It's time corporate bosses noted. The anti-tax avoiders campaign is not going away."

Starbucks UK managing director Kris Engskov made a brave attempt to justify his company's tax arrangements, writing a blog that said they had "paid over £160m in various taxes, including Pay As You Earn for our 8,500 UK employees, national insurance and business rates" over the past three years. The post was later altered to remove the reference to PAYE, which is a tax on employees.

There is no suggestion that Starbucks has done anything illegal, a fact that has led to calls from MPs for an inquiry into the coffee chain's tax affairs and its relationship with the taxman. Others are supporting a consumer boycott.

Lib Dem MP Stephen Williams told the Financial Times that "consumer power" would force Starbucks "to come clean about their tax avoidance activities".

Williams added: "Consumer boycotts have a long tradition in the area of coffee and sugar going right back to 18th century Quaker-led campaigns in Bristol against the slave trade. Think before you drink and maybe we'll get this company to act responsibly." The chairman of the House of Commons public accounts committee, Margaret Hodge, has also called for a boycott.

Meanwhile tax campaigners UK Uncut are reportedly planning sit-ins at branches of Starbucks, a tactic it has previously used to draw attention to the tax affairs of Vodafone and Barclays.

And it's not just consumers that Starbucks has to worry about. CrossCountry is reportedly considering ending sales of Starbucks coffee on its train services, telling The Guardian: "If our customers were to tell us they were unhappy for us to sell them Starbucks coffee then we would, of course, review this arrangement."

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Film reviews: Mission: Impossible—The Final Reckoning, Lilo & Stitch, and Final Destination: Bloodlines

Film reviews: Mission: Impossible—The Final Reckoning, Lilo & Stitch, and Final Destination: BloodlinesFeature Tom Cruise risks life and limb to entertain us, a young girl befriends a destructive alien, and death stalks a family that resets fate's toll.

-

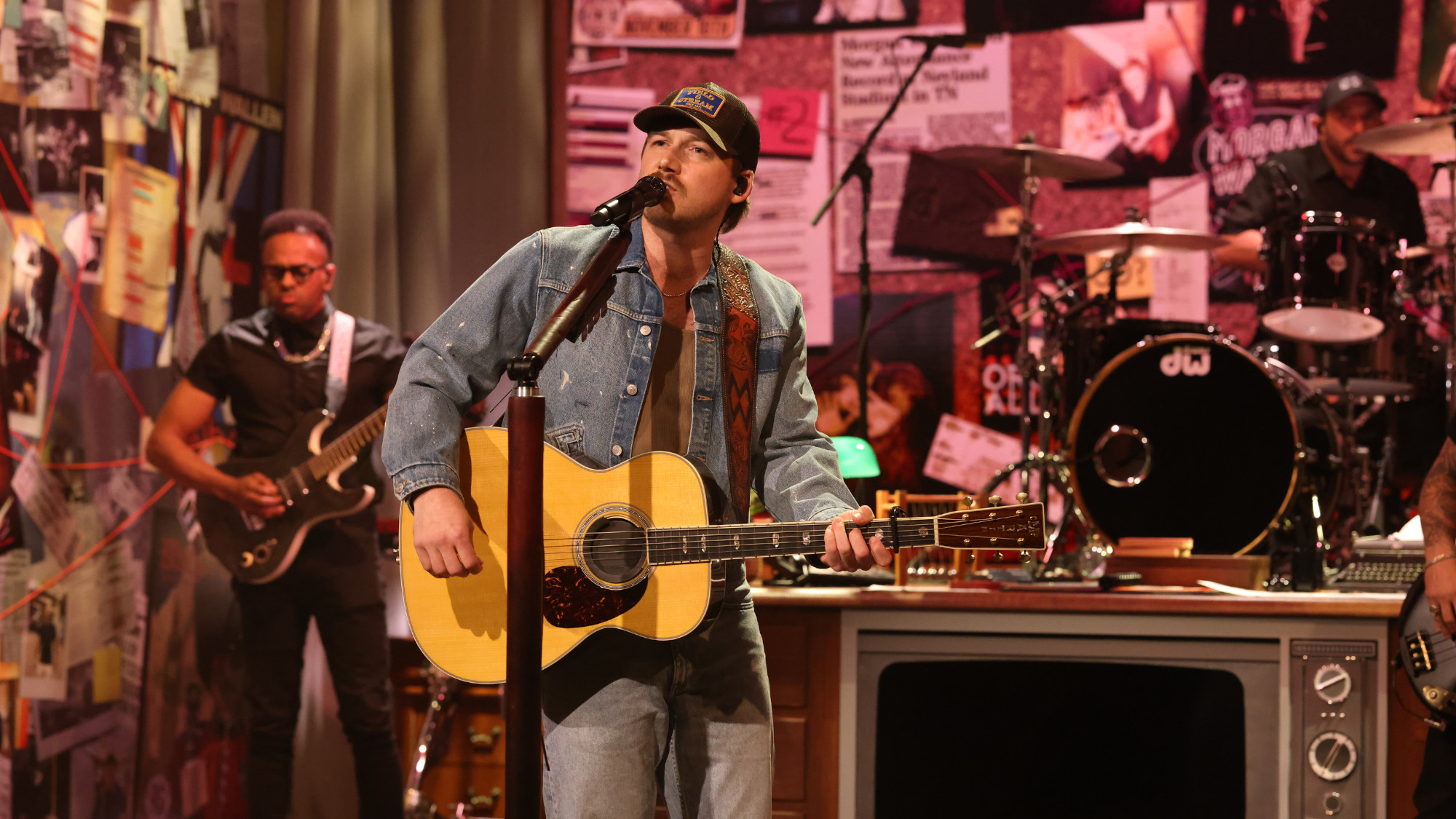

Music reviews: Morgan Wallen and Kali Uchis

Music reviews: Morgan Wallen and Kali UchisFeature "I'm the Problem" and "Sincerely"

-

Art review: Rashid Johnson: A Poem for Deep Thinkers

Art review: Rashid Johnson: A Poem for Deep ThinkersFeature Guggenheim New York, through Jan. 18

-

Angela Rayner: Labour's next leader?

Angela Rayner: Labour's next leader?Today's Big Question A leaked memo has sparked speculation that the deputy PM is positioning herself as the left-of-centre alternative to Keir Starmer

-

Is Starmer's plan to send migrants overseas Rwanda 2.0?

Is Starmer's plan to send migrants overseas Rwanda 2.0?Today's Big Question Failed asylum seekers could be removed to Balkan nations under new government plans

-

Has Starmer put Britain back on the world stage?

Has Starmer put Britain back on the world stage?Talking Point UK takes leading role in Europe on Ukraine and Starmer praised as credible 'bridge' with the US under Trump

-

Left on read: Labour's WhatsApp dilemma

Left on read: Labour's WhatsApp dilemmaTalking Point Andrew Gwynne has been sacked as health minister over messages posted in a Labour WhatsApp group

-

New Year's Honours: why the controversy?

New Year's Honours: why the controversy?Today's Big Question London Mayor Sadiq Khan and England men's football manager Gareth Southgate have both received a knighthood despite debatable records

-

John Prescott: was he Labour's last link to the working class?

John Prescott: was he Labour's last link to the working class?Today's Big Quesiton 'A total one-off': tributes have poured in for the former deputy PM and trade unionist

-

Last hopes for justice for UK's nuclear test veterans

Last hopes for justice for UK's nuclear test veteransUnder the Radar Thousands of ex-service personnel say their lives have been blighted by aggressive cancers and genetic mutations

-

Will Donald Trump wreck the Brexit deal?

Will Donald Trump wreck the Brexit deal?Today's Big Question President-elect's victory could help UK's reset with the EU, but a free-trade agreement with the US to dodge his threatened tariffs could hinder it