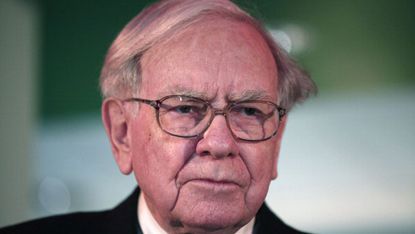

Warren Buffett mistake costs his company $900m

Billionaire admits to a 'big mistake' in spending $2bn without consulting business partner

IN A letter to shareholders, Warren Buffett, the billionaire founder of Berkshire Hathaway, has admitted to making a "big mistake" that cost the company almost $900m (£537m).

Buffett made the admission in his annual letter to Berkshire Hathaway investors, saying he wished he had "never heard" of Energy Future Holdings, after he backed the company without consulting his long-time adviser and vice chairman Charlie Munger.

Buffett said he spent £2bn acquiring debt for a company that now appears to face bankruptcy.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Unless natural gas prices soar, EFH will almost certainly file for bankruptcy in 2014. Last year, we sold our holdings for $259m. While owning the bonds, we received $837m in cash interest. Overall, therefore, we suffered a pre-tax loss of $873m," Buffett explained.

In a deal forged at the peak of the boom that preceded the financial crisis, Texas energy company (TXU) was bought by several private equity firms including KKR, TPG Capital, and Goldman Sachs' private equity arm for $45 billion, CNN Money reports. TXU was later renamed Energy Future.

Subsequent to the deal, the joint equity owners put up $8bn and borrowed a "massive amount" in addition. Buffett bought just under $2bn of those bonds.

The billionaire admitted that the purchase, which resulted in the pre-tax loss of $873m, was a decision he made alone. "Next time I'll call Charlie," Buffett promised.

The loss comes in a year when Berkshire Hathaway failed to outperform the S&P 500 index for only the tenth time in the company's history. Still, over their lifetime, the shares in Berkshire have done outperformed the S&P, increasing by 693,518 per cent since 1965, compared with 9,841 per cent for the S&P, the Daily Telegraph notes.

Buffett affirmed that "Charlie Munger, Berkshire's vice chairman and my partner, and I believe both Berkshire's book value and intrinsic value will outperform the S&P in years when the market is down or moderately up. We expect to fall short, though, in years when the market is strong – as we did in 2013. We have underperformed in ten of our 49 years, with all but one of our shortfalls occurring when the S&P gain exceeded 15 per cent."

In spite of the loss, Buffett pointed to a strong performance in the firm's insurance, rail and energy businesses. Berkshire maintains major investment stakes in beverage company Coca-Cola, the banking group Wells Fargo, and business computing firm IBM.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

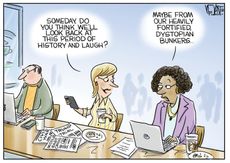

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published

-

University criticised over masturbation PhD

University criticised over masturbation PhDfeature And other stories from the stranger side of life

By Chas Newkey-Burden Published

-

Home Office worker accused of spiking mistress’s drink with abortion drug

Home Office worker accused of spiking mistress’s drink with abortion drugSpeed Read Darren Burke had failed to convince his girlfriend to terminate pregnancy

By The Week Staff Published

-

In hock to Moscow: exploring Germany’s woeful energy policy

In hock to Moscow: exploring Germany’s woeful energy policySpeed Read Don’t expect Berlin to wean itself off Russian gas any time soon

By The Week Staff Published

-

Were Covid restrictions dropped too soon?

Were Covid restrictions dropped too soon?Speed Read ‘Living with Covid’ is already proving problematic – just look at the travel chaos this week

By The Week Staff Last updated

-

Inclusive Britain: a new strategy for tackling racism in the UK

Inclusive Britain: a new strategy for tackling racism in the UKSpeed Read Government has revealed action plan setting out 74 steps that ministers will take

By The Week Staff Published

-

Sandy Hook families vs. Remington: a small victory over the gunmakers

Sandy Hook families vs. Remington: a small victory over the gunmakersSpeed Read Last week the families settled a lawsuit for $73m against the manufacturer

By The Week Staff Published

-

Farmers vs. walkers: the battle over ‘Britain’s green and pleasant land’

Farmers vs. walkers: the battle over ‘Britain’s green and pleasant land’Speed Read Updated Countryside Code tells farmers: ‘be nice, say hello, share the space’

By The Week Staff Published

-

Motherhood: why are we putting it off?

Motherhood: why are we putting it off?Speed Read Stats show around 50% of women in England and Wales now don’t have children by 30

By The Week Staff Published