Dark pool fraud: what is Barclays accused of?

US authorities allege 'disturbing disregard' for investors in Barclays 'dark pool fraud'

Barclays has been accused of "dark pool fraud" by the US authorities, prompting a sharp fall in the company's share price.

New York's attorney general alleges that the British bank falsified documents and displayed a "disturbing disregard" for its investors by misrepresenting the safety of its US-based alternative trading system.

What are dark pools?

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A dark pool is a private trading platform where all activity is concealed from the public. Dark pools allow investors to trade large blocks of shares with complete anonymity, and only post their prices after the deals are done. "They were created as a way for institutional investors to place large orders without disadvantaging themselves by signalling to the wider market any market-moving trades," the Financial Times says.

Why do they exist?

Proponents argue that dark pools allow institutional investors, such as money managers, insurance companies and investment banks, to buy and sell huge quantities of stock without altering the price, or having other traders shift the price in anticipation. Otherwise, for example, a large sale would lower the price while the transaction was in progress, and news of an intention to buy would result in a price rise. But dark pools have come under fire recently due to their lack of transparency, Forbes notes, and some people believe that the secretive systems may actually cause price inefficiencies.

What is dark pool fraud?

New York attorney general Eric Schneiderman says that contrary to its explicit assurances, Barclays had been using its dark pool system to favour high-frequency traders – those firms that use computer systems to buy and sell stock instantaneously based on minor fluctuations in share prices.

"The facts alleged in our complaint show that Barclays demonstrated a disturbing disregard for its investors in a systematic pattern of fraud and deceit," Schneiderman said. "Barclays grew its dark pool by telling investors they were diving into safe waters. According to the lawsuit, Barclays' dark pool was full of predators – there at Barclays' invitation."

The lawsuit claims that Barclays never intervened to eject a single trader.

High-frequency trading has itself come under scrutiny recently, The Guardian notes, following the publication in March of best-selling author Michael Lewis' book, Flash Boys: A Wall Street Revolt, which argues that high-frequency traders have effectively "rigged the stock market" by using systems that are not available to others.

How has Barclays responded to the allegations?

The bank says that it was monitoring trade within its dark pool and "predatory" traders would be held to account.

"We take these allegations very seriously," the bank said. "Barclays has been co-operating with the New York attorney general and the SEC and has been examining this matter internally."

Schneiderman said that the lawsuit was compiled with the help of former senior Barclays traders. It seeks an unstated amount of damages and restitution.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

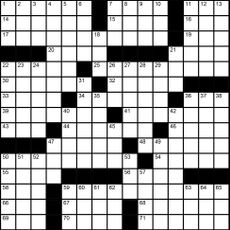

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine printables - May 3, 2024

Magazine printables - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Why Barclays CEO Jes Staley stepped down over Jeffrey Epstein investigation

Why Barclays CEO Jes Staley stepped down over Jeffrey Epstein investigationWhy Everyone’s Talking About Cache of emails between the two men prompted probe by UK regulators

By The Week Staff Published

-

Jes Staley: how Barclays boss is involved in Epstein scandal

Jes Staley: how Barclays boss is involved in Epstein scandalIn Depth Chief executive says he now ‘deeply regrets’ friendship with paedophile financier

By The Week Staff Last updated

-

Barclays and RBS among banks to face £1bn forex lawsuit

Barclays and RBS among banks to face £1bn forex lawsuitSpeed Read Action follows European Commission ruling that lenders had broken EU competition law

By The Week Staff Last updated

-

FBI warns cash machine global cyber-attack imminent

FBI warns cash machine global cyber-attack imminentSpeed Read British banks have been warned their ATMs could be mass-hacked by cyber criminals ‘in the coming days’

By The Week Staff Last updated

-

Barclays’ Qatar bailout charges dismissed

Barclays’ Qatar bailout charges dismissedSpeed Read Serious charges thrown out, in a ‘major setback’ for the Serious Fraud Office

By The Week Staff Last updated

-

Barclays Bank charged over Qatari loan

Barclays Bank charged over Qatari loanSpeed Read Serious Fraud Office allege 2008 bailout money was used to provide ‘unlawful financial assistance’

By The Week Staff Last updated

-

Barclays and four ex-bankers charged with 2008 fraud

Barclays and four ex-bankers charged with 2008 fraudIn Depth Former chief executive John Varley and three other directors accused over crisis-era fundraising

By The Week Staff Last updated

-

Barclays hit by £38m fine for putting clients' money 'at risk'

Barclays hit by £38m fine for putting clients' money 'at risk'Speed Read FCA dishes out biggest fine ever after Barclays failed to keep clients' assets separate from its own

By The Week Staff Published