Nando's tax haven network exposed

A network of secretive trusts is exposed as Nando's tax controversy hots up

A £750m Channel Islands trust is top of a long and varied menu of offshore companies used by the chicken chain Nando's to reduce its tax liabilities.

Use of the offshore tax haven means the family of Nando's owner Dick Enthoven stands to avoid UK inheritance tax on its entire fortune, which includes an £8m Wiltshire stately home, The Guardian reports.

The restaurant group also uses a complex web of offshore accounting techniques to minimise its tax bill.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Buy a £7.30 portion of spicy chicken thighs at Nando's," the paper says, "and the cash flows into a network of accounting devices, involving Malta, the Isle of Man, Guernsey, the Netherlands, Ireland, Luxembourg, Panama and the British Virgin Islands."

The network helps the food chain to reduce its UK corporation tax bill – legally – by up to a third.

Nando's points out that it paid £12.6m in UK corporation tax last year.

"In the UK, Nando's Group Holdings Ltd incurred corporation tax of £12.6m on a profit of £58.2m with revenues of £485.2m in the year ending February 2013," a company spokesman said.

However, The Guardian calculates that the tax bill might have been half as much again, at £18m, had offshore arrangements not existed.

The news comes in a week in which tax avoidance has received renewed attention. Sir Michael Caine and Katie Melua were among a host of big names exposed for their use of the aggressive tax avoidance scheme Liberty, while treasury minister Andrea Leadsom was asked explain a total of £816,000 of political donations to the Conservatives made by her own Guernsey banker brother-in-law.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 20, 2024

Today's political cartoons - April 20, 2024Cartoons Saturday's cartoons - papal ideas, high-powered debates, and more

By The Week US Published

-

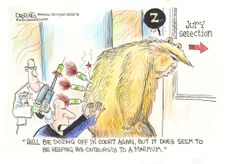

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published