Inflation spike prompts talk of interest rate rises

Inflation rose from 1.5% in May to 1.9% in June, close to the Bank of England's 2% target

The rate at which the prices of goods and services to UK consumers is increasing has risen sharply, the Office for National Statistics says. The latest Consumer Prices Index (CPI) shows the nation's consumer inflation rate at 1.9 per cent, close to the Bank of England's two per cent target.

The CPI is a measure of the average national cost of a basket of 700 consumer goods and services. Each month, the ONS produces a figure showing the percentage increase on the same month in the previous year.

This May, the basket cost 1.5 per cent more than it did in May 2013; by June the rate of increase in prices had risen to 1.9 per cent.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The new rate is close to the Bank's target rate of two per cent. The Bank seeks to limit inflation by setting interest rates, so the news of a sharp rise in the CPI prompted speculation that the Governor, Mark Carney, will soon announce an interest rate rise.

Chris Williamson, chief economist at research firm Markit, told the BBC: "The news will further fuel expectations that the Bank of England will start raising interest rates sooner rather than later, with November looking the most likely month for the first hike."

According to the ONS, the inflation rise was driven by increased prices for women's clothing, air fares and furniture. Footwear, food and non-alcoholic drink prices also pushed the rate up.

Another economist, World First's Jeremy Cook, told the BBC the inflation rise was a "big surprise". He pointed out that for the many people coping for several years with wages rising at a lower rate than inflation, "the situation just got a little more painful".

New figures on wages for the three months to May 2014 are due from the ONS this week. After six years of not keeping up with inflation, average wages began to rise again in April - but still not as fast as the cost of living.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

AI is causing concern among the LGBTQ community

AI is causing concern among the LGBTQ communityIn the Spotlight One critic believes that AI will 'always fail LGBTQ people'

By Justin Klawans, The Week US Published

-

'Modern presidents exercise power undreamed of by the Founding Fathers'

'Modern presidents exercise power undreamed of by the Founding Fathers'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

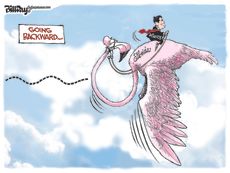

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published