ATM hack lets criminals take 'wads of cash'

Tyupkin hack allows fraudsters to enter a Pin code and take out up to 40 notes at once

A flaw in cash machine software is letting criminals withdraw money without using a bank card.

Security firm Kaspersky Labs identified the problem, leading Interpol to mount a widespread investigation across the USA, India, France, Israel, Malaysia and China.

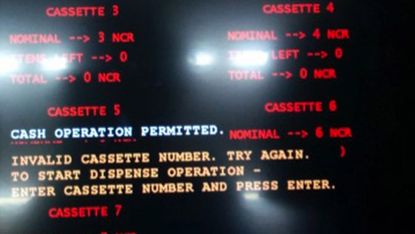

ATMs infected with malicious software can be instructed to give out 40 notes at once by entering a series of digits on the keypad. Fraudsters do not require a credit or debit card to carry out the scam.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The hack, known as Tyupkin, requires criminals to enter a unique code into a machine that has already been compromised by the malware. A second Pin code – a random sequence of numbers generated at another location – is also needed to unlock the machine before it will dispense the cash.

Security analysts say that this double-Pin system ensures that the hacker generating the algorithms maintains control over when and where money can be stolen.

"Over the last few years, we have observed a major upswing in ATM attacks using skimming devices and malicious software," said Vicente Diaz, principal security researcher at Kaspersky. "Now we are seeing the natural evolution of this threat with cybercriminals moving up the chain and targeting financial institutions directly."

Millions of dollars have already been stolen around the world, the Daily Mirror says, and it is possible that cash machines in the UK could come to be affected.

Tyupkin is said to affect a particular make of ATM which runs Microsoft Windows 32-bit. The initial security investigation was carried out by Kaspersky at the "request of a financial institution" – but the security firm did not specify which.

Unlike some other scams, the Tyupkin hack skims money from the bank itself rather than targeting individual bank accounts.

Many machines run outdated software, the BBC says, "which is hard to update for logistical and financial reasons". Many also require a full hardware overhaul to address contemporary security threats.

"The fact that many ATMs run on operating systems with known security weaknesses and the absence of security solutions is a problem that needs to be addressed urgently," Kaspersky says.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The toilet roll tax: UK's strange VAT rules

The toilet roll tax: UK's strange VAT rulesThe Explainer 'Mysterious' and 'absurd' tax brought in £168 billion to HMRC last year

By The Week UK Published

-

Why is Tesla stumbling?

In the Spotlight More competition, confusion about the future and a giant pay package for Elon Musk

By Joel Mathis, The Week US Published

-

How Taylor Swift changed copyright negotiations in music

How Taylor Swift changed copyright negotiations in musicunder the radar The success of Taylor's Version rerecordings has put new pressure on record labels

By Theara Coleman, The Week US Published

-

What we know about the Copenhagen mall shooting

What we know about the Copenhagen mall shootingSpeed Read Lone gunman had mental health issues and not thought to have terror motive, police say

By The Week Staff Published

-

Texas school shooting: parents turn anger on police

Texas school shooting: parents turn anger on policeSpeed Read Officers had to be urged to enter building where gunman killed 21 people

By The Week Staff Published

-

DJ Tim Westwood denies multiple sexual misconduct allegations

DJ Tim Westwood denies multiple sexual misconduct allegationsSpeed Read At least seven women accuse the radio and TV presenter of predatory behaviour dating back three decades

By The Week Staff Published

-

What happened to Katie Kenyon?

What happened to Katie Kenyon?Speed Read Man charged as police search for missing 33-year-old last seen getting into van

By The Week Staff Last updated

-

Brooklyn subway shooting: exploring New York’s ‘steep decline in law and order’

Brooklyn subway shooting: exploring New York’s ‘steep decline in law and order’Speed Read Last week, a gunman set off smoke bombs and opened fire on a rush-hour train in the city

By The Week Staff Last updated

-

How the Capitol attack investigation is splitting the Republicans

How the Capitol attack investigation is splitting the RepublicansSpeed Read Vote to censure two Republican representatives has revealed deep divisions within party

By The Week Staff Published

-

Is sentencing a Nazi sympathiser to read Shakespeare an appropriate punishment?

Is sentencing a Nazi sympathiser to read Shakespeare an appropriate punishment?Speed Read Judge seemed to think introducing student ‘to high culture’ would ‘magically make him a better person’ said The Daily Telegraph

By The Week Staff Published

-

Sarah Everard’s murder: a national reckoning?

Sarah Everard’s murder: a national reckoning?Speed Read Wayne Couzen’s guilty plea doesn’t ‘tidy away the reality of sexual violence’

By The Week Staff Last updated