Companies

-

The nightmare before Christmas: is the party over for the office festive do?

Talking Point Seasonal cheer and morale-boosting benefits under threat from economic woes and employee disinterest – or dread

By Harriet Marsden, The Week UK Last updated

Talking Point -

Microsoft cleared by UK watchdog to buy 'Call of Duty' maker

Speed Reads Watchdog finally approves $69bn deal but criticises tech giant for its tactics

By Chas Newkey-Burden, The Week UK Published

Speed Reads -

Alexandr Wang: the world’s youngest self-made billionaire shaking up tech

Why Everyone’s Talking About The college dropout has made his fortune supplying AI companies with human labour

By Keumars Afifi-Sabet Published

Why Everyone’s Talking About -

The rise and rise of Center Parcs: ‘the paradise machine’

In Depth The holiday resort chain is up for sale, with a price tag somewhere north of £4bn. What is the secret of its success?

By The Week Staff Published

In Depth -

What’s happening at McDonald’s?

Under the Radar Fast-food chain closed US offices and told staff to work from home while it announces job cuts

By Harriet Marsden Published

Under the Radar -

Britishvolt: how Britain’s bright battery hope was zapped

feature Battery-making startup’s demise ‘has thrown up tales of reckless spending’ and incompetence

By The Week Staff Published

feature -

Water bill discounts: the customers due to save money

feature Watchdog orders Thames Water and Southern Water among others to repay millions to customers for missing targets

By The Week Staff Last updated

feature -

Foreign investors go bargain-hunting as pound hits record lows

Business Briefing The “UK is cheap” narrative has turned some of our best companies into 'sitting ducks'

By The Week Staff Published

Business Briefing -

Center Parcs et al: a right royal PR fiasco

Talking Point Incident was merely the most extreme example of a brand making a mess of its royal tribute

By The Week Staff Last updated

Talking Point -

Boom Supersonic: is the ‘son of Concorde’ just a fantasy?

Under the Radar Claims of profitable ‘ultrafast jet travel’ have been met with ‘intense industry scepticism’

By The Week Staff Published

Under the Radar -

DHS watchdog opens criminal inquiry of erased Secret Service Jan. 6 texts

Speed Read

By Harold Maass Published

Speed Read -

Celsius: crypto lender sparks manic meltdown

Business Briefing Total value of the crypto market is now below $1trn – down from almost $3trn in November

By The Week Staff Published

Business Briefing -

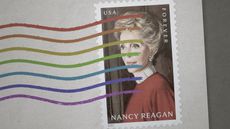

What's all the hullabaloo over the Nancy Reagan stamp?

opinion The sharpest opinions on the debate from around the web

By Grayson Quay Published

opinion -

Sheryl Sandberg’s mixed legacy

Why Everyone’s Talking About The most important woman in tech is leaving Meta. Will she be missed?

By The Week Staff Published

Why Everyone’s Talking About