Business

-

Can Trump get a fair trial?

Talking Points Donald Trump says he can't get a fair trial in heavily Democratic Manhattan as his hush money case starts

By Harold Maass, The Week US Published

Talking Points -

Grindr 'shared user HIV status' with ad firms, lawsuit claims

Speed Read LGBTQ dating app accused of breaching UK data protection laws in case filed at London's High Court

By Rebecca Messina, The Week UK Published

Speed Read -

UAW scores historic win in South at VW plant

Speed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

Speed Read -

Tesla cuts prices in 'intensifying' EV war

Speed Read Electric vehicle giant has struggled in the face of weakening demand, competition from China and technical setbacks

By Arion McNicoll, The Week UK Published

Speed Read -

Why au pairs might become a thing of the past

Under The Radar Brexit and wage ruling are threatening the 'mutually beneficial arrangement'

By Chas Newkey-Burden, The Week UK Published

Under The Radar -

Controversy is brewing over a lawsuit involving Hermès' luxury bags

Talking Point The lawsuit alleges the company only sells bags to people with a 'sufficient purchase history'

By Justin Klawans, The Week US Published

Talking Point -

Empty-nest boomers aren't selling their big homes

Speed Read Most Americans 60 and older do not intend to move, according to a recent survey

By Peter Weber, The Week US Published

Speed Read -

Reading glasses could be an economic boost to people in low-income countries

Under the Radar A recent study found that providing glasses can significantly raise a person's earning power

By Justin Klawans, The Week US Published

Under the Radar -

The wine industry is getting pressed as young people drink less

Under the Radar The once-dominating drink is not aging well

By Anya Jaremko-Greenwold, The Week US Published

Under the Radar -

Brazil accuses Musk of 'disinformation campaign'

Speed Read A Brazilian Supreme Court judge has opened an inquiry into Elon Musk and X

By Rafi Schwartz, The Week US Published

Speed Read -

The largest insurance company payouts

In The Spotlight Fights over insurance have been in the spotlight following the collapse of the Francis Scott Key Bridge in Baltimore

By Justin Klawans, The Week US Published

In The Spotlight -

Disney board fends off Peltz infiltration bid

Speed Read Disney CEO Bob Iger has defeated activist investor Nelson Peltz in a contentious proxy battle

By Rafi Schwartz, The Week US Published

Speed Read -

What RFK Jr.'s running mate pick says about his candidacy

Talking Points Robert F. Kennedy Jr.'s' running mate brings money and pro-abortion-rights cred to his longshot presidential bid

By Harold Maass, The Week US Published

Talking Points -

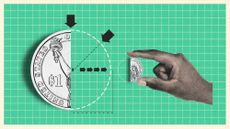

Why are dollar stores a microcosm for America's shrinkflation problem?

Today's Big Question Recent reports have tapped dollar stores as the top offenders of shrinkflation — even beyond grocery stores

By Justin Klawans, The Week US Published

Today's Big Question