Raising top tax rate to 50p will bring in little or no revenue

Paul Johnson and David Phillips of the Institute of Fiscal Studies question Ed Balls's tax pledge

ED BALLS, the shadow chancellor, has announced that if elected a Labour government would return the rate of income tax payable on incomes above £150,000 to 50 per cent. What would the effect of this be?

Labour's contention is that it would raise a meaningful sum of money to help reduce the budget deficit and make for a fairer tax system. The contention of their opponents is that it could result in an exodus of talent from the UK, a reduction in entrepreneurial drive, and an increase in tax avoidance and evasion, and may actually reduce the amount of tax paid.

Who is right is important not just for the lucky few who have incomes high enough that they would be directly affected. It matters for everyone because the exchequer is, perhaps worryingly, reliant on this very small group of individuals for a very large fraction of revenue: the 1 per cent of income tax payers with incomes in excess of £150,000 pay somewhere between 25 and 30 per cent of all income tax. How these people would respond to a change in tax rates can therefore have big implications for overall tax revenues.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Perhaps the best evidence we have at present is that produced by HMRC in 2012, and signed off by the Office for Budget Responsibility. This suggested that cutting the 50p rate to 45p could reduce revenue by about £3.5 billion in 2015–16 if there was no change in behaviour by those affected. However, once you allow for behavioural response, their central estimate was a cost of just £100 million – a very small amount of money. The best available estimate of what reversing the cut would raise is therefore about £100 million too.

But it is important to bear in mind that there is substantial uncertainty around this central estimate. Calculating the revenue effects allowing for behavioural response requires one to estimate the “taxable income elasticity” – the extent to which taxable income changes when the tax rate changes.

HMRC’s central estimate is that this elasticity was 0.45, which is broadly in line with estimates by IFS researchers based on the last time the top rate of income tax changed in the 1980s, and with estimates from a number of other countries. If instead the true elasticity was 0.35 (which is well within the range of uncertainty), reducing the top rate of tax from 50p to 45p will have cost the exchequer about £700m, while if the true elasticity was 0.55 (again, within the range of uncertainty), it will have actually raised about £600m.

In other words cutting the top rate of tax may have cost the government a bit more than it thought or actually raised a bit. This evidence led the OBR chairman Robert Chote to conclude that, whatever the precise answer, we were “strolling across the summit of the Laffer curve” (the relationship between tax rates and revenue).

Has anything changed since then? Ed Balls and Ed Miliband have suggested that the most recent HMRC statistics show those paying 50 per cent income tax have paid some £10 billion more over the three years to 2012–13 than was thought back in 2012 when HMRC did their analysis.

The statistics in question are estimates and projections of tax liabilities based on the Survey of Personal Income, which is itself based on a sample of tax records. The versions of these tables from 2012 and 2013 do show a difference of around £10 billion in the total amount of tax paid by those paying the 50p rate in the years between 2010–11 and 2012–13. So is that an indication that the 50p rate was more successful in raising revenue than HMRC first assumed?

Looking carefully at the notes that accompany the 2012 tables cited by the Labour Party shows that the figures for 2010–11 to 2012–13 were projected tax payments based on how much tax was paid in 2009–10, before the 50p tax rate was introduced. Had the HMRC’s analysis of taxable income elasticity been based on these original, lower, projections for tax revenues then we might have good reason for questioning their analysis. In fact it was not.

In their analysis, HMRC made use of the actual 2010–11 tax returns of people paying by self-assessment (who make up the vast majority of people who paying the 50p rate of tax). This is pretty much the same data (bar a few late filers and those few 50p rate taxpayers not required to fill in a self-assessment form) that then goes into producing the Survey of Personal Income data used in the most recent 2013 tables. These tables show 50p taxpayers paid £34.5 billion in income tax in 2010–11 on an income of £86.5 billion (and HMRC’s analysis assumed their income was £87 billion). So in fact there is little additional evidence to suggest that a 50p rate would raise more than was estimated by HMRC back in 2012.

Of course, even if increasing the top rate of income tax raised little or nothing you might still consider it worthwhile if you have a very strong preference for reducing inequality. Some effect has of course already been felt since the recession hit through the combination of the 45p rate itself, a major reduction in pension tax reliefs, and the withdrawal of the personal income tax allowance for those on high incomes.

Our analysis of the effect of policy changes since the recession suggests people with incomes higher than £100,000 have on average seen a bigger percentage hit to their incomes from tax and benefit policies than people in any other part of the income distribution. But the group with incomes over £150,000 a year remains extremely well off relative to the majority.

The uncertainty around HMRC’s estimates means it is also possible that the 50p rate would be somewhat more effective at raising revenue than their initial analysis suggests. HMRC made their calculations at great speed on the basis of one year’s data that had only just become available. Indeed only around 95 per cent of the data was available at the time they made the calculation.

By now they have data for 2011–12 too, and soon they will have data for 2012–13 as well. Given this, there is certainly a case for HMRC looking again.

But at the moment, the best evidence we have still suggests that raising the top rate of tax would raise little revenue and make, at best, a marginal contribution to reducing the budget deficit an incoming government would face after the next election.

Paul Johnson is the director of the Institute for Fiscal Studies and David Phillips is a senior research economist at the Institute for Fiscal Studies. This article was originally published at The Conversation.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

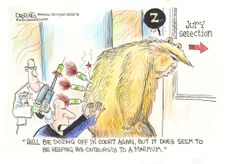

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'Why Everyone's Talking About Masters victory is Scheffler's second in three years

By The Week Staff Published

-

Will Aukus pact survive a second Trump presidency?

Will Aukus pact survive a second Trump presidency?Today's Big Question US, UK and Australia seek to expand 'game-changer' defence partnership ahead of Republican's possible return to White House

By Sorcha Bradley, The Week UK Published

-

It's the economy, Sunak: has 'Rishession' halted Tory fightback?

It's the economy, Sunak: has 'Rishession' halted Tory fightback?Today's Big Question PM's pledge to deliver economic growth is 'in tatters' as stagnation and falling living standards threaten Tory election wipeout

By Harriet Marsden, The Week UK Published

-

'A ridiculous amount of money pledged to someone who already was absurdly rich'

'A ridiculous amount of money pledged to someone who already was absurdly rich'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Why your local council may be going bust

Why your local council may be going bustThe Explainer Across England, local councils are suffering from grave financial problems

By The Week UK Published

-

Rishi Sunak and the right-wing press: heading for divorce?

Rishi Sunak and the right-wing press: heading for divorce?Talking Point The Telegraph launches 'assault' on PM just as many Tory MPs are contemplating losing their seats

By Keumars Afifi-Sabet, The Week UK Published

-

'Mixing new technology and new laws is always a fraught business'

'Mixing new technology and new laws is always a fraught business'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

Bipartisan group pitches Child Tax Credit expansion

Bipartisan group pitches Child Tax Credit expansionSpeed Read Congressional negotiators have unveiled their nearly $80 billion tax plan — now they have to pass it.

By Rafi Schwartz, The Week US Published