UK growth up 0.8 per cent: is it good news for enough of us?

'Fairness' on the agenda as rising growth fails to bring 'feel good factor' to enough of the population

THE latest growth figures, released this morning, show that Britain's economic recovery remains on track with Gross Domestic Product rising at 0.8 per cent, faster than the rest of the EU.

The GDP figure for the first quarter of 2014 was slightly up on the 0.7 per cent for the last quarter of 2013, but less than some analysts had predicted. There are also concerns that growth is being fuelled by householders spending more of their savings.

But the figures were welcomed as good news by George Osborne, the Chancellor, and David Cameron, the Prime Minister, who are feeling increasingly confident that, with just a year to go before the general election, a growing "feel good factor" might yet turn the tide and keep the Conservatives in government.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, there is increasing concern inside and outside the government that far too few of the population are sharing the country's growing prosperity: that the super-rich - bankers and multi-national corporation executives - are getting richer, while the rest of us are failing to enjoy an income boost.

Andy Harrison, chief executive of Whitbread, which owns Costa Coffee and Premier Inns and today reported an increase in full-year earnings of 16.5 per cent, added weight to Labour's claim that the economy is growing much faster in Greater London than the rest of the country.

Harrison told Radio 4's Today programme: "Inside the M25 it is going from strength to strength. Outside the M25, it is growing but it is fragile."

The rise of the super-rich has left the coalition vulnerable to Labour’s charge of “unfairness”. Cameron’s claim when he launched the coalition government's austerity programme in 2010 that "we are all in this together" is now taken as a sick joke as voters watch bankers receive even more generous bonuses, despite shareholders’ protests.

Ed Miliband, the Labour leader, is about to shift Labour’s focus from the "rich versus the poor" to "the super-rich versus the rest of us".

And Vince Cable, the Lib Dem Business Secretary, has written to the country's 100 biggest companies warning them that they will only restore public trust by showing restraint with boardroom pay rises.

The inequality agenda will be raised again this week with the arrival of the French “rock star economist” Thomas Piketty to promote his book, Capital in the 21st Century, which,as Rachel Sylvester reports in The Times, is exciting politicians in Washington and London.

Picketty proposes a Francois Hollande-style global tax on wealth and an upper rate of 80 per cent on tax, even higher than the top rate in France (which has spurred many French businessmen to hop across the Channel to London). Sylvester says Labour won’t be adopting Picketty’s policies, but they share his analysis.

Labour will, however, go back to a top rate of 50p on those earning more than £150,000 a year if they win the 2015 election. Ed Balls, the Shadow Chancellor, said on Radio 5 Live this morning: "We will reverse the top rate tax cut and keep it at 50 per cent.

"It’s positive that we have got growth back in the economy," he went on. "But it’s happened much too late. The issues now are: is it balanced growth and are people going to share in the rising prosperity?

"We will have a housing market that is too unbalanced. The Chancellor set out in his Budget that growth is dependent on savings falling – that is the opposite of the business-led recovery we need."

But Ed Balls still has to persuade voters that David Cameron wasn't wrong when he said that giving Labour run the chance to run the economy again was like handing the keys back to the people who crashed the car.

While George Osborne has to persuade us that giving the Tories another five years won't simply add to the coffers of the super-rich. "Britain is coming back but we have to carry on working through our economic plan," was his reaction this morning to the GDP news.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

AI is causing concern among the LGBTQ community

AI is causing concern among the LGBTQ communityIn the Spotlight One critic believes that AI will 'always fail LGBTQ people'

By Justin Klawans, The Week US Published

-

'Modern presidents exercise power undreamed of by the Founding Fathers'

'Modern presidents exercise power undreamed of by the Founding Fathers'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

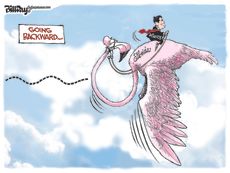

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

Will Aukus pact survive a second Trump presidency?

Will Aukus pact survive a second Trump presidency?Today's Big Question US, UK and Australia seek to expand 'game-changer' defence partnership ahead of Republican's possible return to White House

By Sorcha Bradley, The Week UK Published

-

It's the economy, Sunak: has 'Rishession' halted Tory fightback?

It's the economy, Sunak: has 'Rishession' halted Tory fightback?Today's Big Question PM's pledge to deliver economic growth is 'in tatters' as stagnation and falling living standards threaten Tory election wipeout

By Harriet Marsden, The Week UK Published

-

Why your local council may be going bust

Why your local council may be going bustThe Explainer Across England, local councils are suffering from grave financial problems

By The Week UK Published

-

Rishi Sunak and the right-wing press: heading for divorce?

Rishi Sunak and the right-wing press: heading for divorce?Talking Point The Telegraph launches 'assault' on PM just as many Tory MPs are contemplating losing their seats

By Keumars Afifi-Sabet, The Week UK Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

How the biggest election year in history might play out

How the biggest election year in history might play outThe Explainer Votes in world's biggest democracies, as well as its most 'despotic' and 'stressed' countries, face threats of violence and suppression

By Harriet Marsden, The Week UK Published

-

'Good democracies include their poorest citizens. The UK excludes them'

'Good democracies include their poorest citizens. The UK excludes them'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published