Politics of Mark Carney: SNP and Labour have cause to shudder

With his warning to the Scots and his comments on Labour's bank reforms, has the Governor gone too far?

IS MARK CARNEY, Governor of the Bank of England, getting too political? It's a question raised, not for the first time, after yesterday's intervention over sterling appeared to put the skids under Alex Salmond's Yes campaign for Scottish independence. Carney told an audience of business figures after meeting Salmond at Bute House that if Scotland wanted a durable, successful currency union with the Bank of England then it will require "some ceding of national sovereignty" by Scotland. The Scotsman today reports a Scottish Government spokesman accepting Carney's point that there would have to be a sharing of risk and fiscal stability across Scotland and what remained of the UK. "Any independent government looks at pooling sovereignty on a range of fronts," the spokesman told the paper. "This is done when it is in the country's interests to pool sovereignty, and rules and structures are put in place. We would still be responsible for our own taxation." Which raises the question: what is the point of Scottish independence and the Great Scottish Referendum later this year? As James Kirkup, political correspondent of the Daily Telegraph, put it in his ‘evening briefing' yesterday, Carney has "lobbed a hand grenade into the Scottish independence debate". Kirkup's colleague Ben Brogan added this morning: "Mr Carney delivered an unpalatable home truth to Mr Salmond: you can have independence, or the pound, but not both; and if Scotland were to join a currency union with Britain, it would have to hand over more fiscal powers than countries in the eurozone currently have to. "The intervention clearly represents a setback for Mr Salmond. As our leader points out, ‘Independence would not only leave the Scots in a materially precarious situation but, ironically, less free than before'." But the far more significant message that has emerged from Carney's intervention - at least for those south of the border who won't get a say in the referendum - is the extent to which he is prepared to engage in highly controversial political issues, and how that may read across to his relations with Ed Balls, Labour's shadow chancellor, and George Osborne, the Tory Chancellor who appointed him. As Kirkup put it yesterday, "Despite his eloquent protestations to the contrary, he [Carney] is turning out to be a rather political governor." Indeed, this is not the first time Carney has tip-toed into the political arena. Soon after arriving at the Bank from Canada last year, Carney and the Monetary Policy Committee (MPC) issued forward advice to the City that serious consideration would be given to raising interest rates when unemployment fell to seven per cent. Last week unemployment fell to 7.1 per cent - threatening a rise in interest rates that could choke off all those home-buyers boosting the economy through mortgages and purchases of household goods to fill their new homes and, in one fell swoop, scupper Osborne's plans. But Carney immediately indicated that there was no immediate increase in interest rates in prospect. That got a big sigh of relief from the Treasury. But was it an economic decision, or a political one? And that's not all. When the news broke earlier this month that Ed Miliband wanted to impose a limit on the market share of individual banks, Carney was asked for his view by members of the Commons Treasury select committee. "Just breaking up an institution doesn't necessarily create or enable a more intensive competitive structure," the Carney responded. A cap on market share, he said, would "not result in substantial improvement to competition". As one of the BBC political team, Chris Mason, commented at the time, Carney also made it clear that he didn't favour Miliband's other big idea – a cap on banker's bonuses.

When shadow business secretary Chuka Umunna was asked later about Carney's remarks, he responded coolly: "I actually had an exchange in July 2010 with Mark Carney's predecessor, then Sir Mervyn King. He made it very clear to me that it is not a good thing for governors of the Bank of England to be involved in political matters."

Labour's shadow Treasury team will be watching like hawks to see if the Governor takes decisions in the run-up to the 2015 general election that can be construed as "political" to help Osborne win re-election for the Conservatives. Carney and his team might deny that anything so crude could possibly happen at the Bank of England, but don't underestimate the room for conflict between Chancellors and the Governor. We now know, thanks to Damian McBride's memoirs, that back in 2004 when Gordon Brown was Chancellor he issued a four-letter tirade against Mervyn King (albeit over the CIA spying on us rather than the economy). McBride recalls how Brown told King he was talking "f***ing bull****" when he said he had a duty to speak out and that it was his "f***ing ego dictating his position, not his duty to the country". You can expect Ed Balls to say something similar if there is any suggestion of Carney acting politically from his perch in Threadneedle Street.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

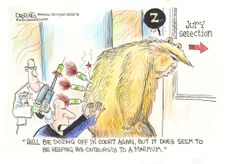

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'Why Everyone's Talking About Masters victory is Scheffler's second in three years

By The Week Staff Published

-

Will Aukus pact survive a second Trump presidency?

Will Aukus pact survive a second Trump presidency?Today's Big Question US, UK and Australia seek to expand 'game-changer' defence partnership ahead of Republican's possible return to White House

By Sorcha Bradley, The Week UK Published

-

It's the economy, Sunak: has 'Rishession' halted Tory fightback?

It's the economy, Sunak: has 'Rishession' halted Tory fightback?Today's Big Question PM's pledge to deliver economic growth is 'in tatters' as stagnation and falling living standards threaten Tory election wipeout

By Harriet Marsden, The Week UK Published

-

Why your local council may be going bust

Why your local council may be going bustThe Explainer Across England, local councils are suffering from grave financial problems

By The Week UK Published

-

Rishi Sunak and the right-wing press: heading for divorce?

Rishi Sunak and the right-wing press: heading for divorce?Talking Point The Telegraph launches 'assault' on PM just as many Tory MPs are contemplating losing their seats

By Keumars Afifi-Sabet, The Week UK Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

How the biggest election year in history might play out

How the biggest election year in history might play outThe Explainer Votes in world's biggest democracies, as well as its most 'despotic' and 'stressed' countries, face threats of violence and suppression

By Harriet Marsden, The Week UK Published

-

'Good democracies include their poorest citizens. The UK excludes them'

'Good democracies include their poorest citizens. The UK excludes them'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published