The pros and cons of ditching cash

Cash use is at an all-time low – but what does that mean for non-digital natives?

By 2031, just one in every 20 transactions will be made using cash, the banking trade body has predicted.

UK Finance said that 56% of all payments in 2010 were made using cash, falling to just 15% last year. Around 23.1 million people in Britain are thought to use cash for a payment just once a month or not at all, with just 1.1 million people still using it as their primary form of payment. Nevertheless, said The Telegraph, the “death of cash” is near.

The Covid-19 pandemic is thought to have accelerated the decline of cash with retailers encouraging what the BBC described as “friction-free payments”. A survey by the consumer group Which? found that one in ten people were refused service by shops when trying to purchase essential items with cash during the pandemic.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

At a recent Tory leadership hustings near Belfast, Liz Truss vowed to do what she could to stop physical money from being phased out. “It seems to me some businesses will only accept cash and some businesses will only accept cards,” she told those present. “We should make sure people are able to use cash where they don’t have alternatives. I think that is important.”

For many digital natives, the switch to contactless is a painless one, but for vulnerable people, the closure of cashpoints and a shift to digital currencies could prove very difficult.

Pro: reduces crime rates

“Numerous studies have shown that going cashless reduces crime rates significantly,” said Mark Scott, director of loan company Swift Money. When people handle less physical cash, “the rate of crimes like bank robberies, burglaries, extortion, and corruption decline significantly”, he continued.

In 2019, the independent Access to Cash review repeated Scott’s claim, stating that there is “clear evidence that cash plays a large role in facilitating crime because it’s untraceable”.

Con: Brits could be left adrift

Almost one in five Britons would be left adrift if the UK transitioned to a cashless society, according to the Access to Cash review.

The groups expected to be most affected include elderly people, residents in rural communities with poor broadband and mobile connectivity, and those struggling with debt for whom cash is easier to manage.

Money-saving expert Martin Lewis, founder of the charity the Money and Mental Health Policy Institute, highlighted the risks posed to vulnerable people and communities. He told the i news site: “Many, especially the more affluent and technologically savvy, now live mostly cashless lives. That’s exactly why protecting access to cash is so important.”

Pro: more secure

Proponents of a cashless society argue that technology offers a much more secure way to store your wealth as well.

“It’s very easy to shut down a digital wallet remotely if it falls into the wrong hands”, and “a secure digital system that implements biometrics” would be “very hard to copy”, said the finance blog Money Crashers.

Supporters of the move also believe it would result in greater ease in people’s day-to-day interactions with money.

Con: ripple effect

Access to Cash review chair Natalie Ceeney told The Times that in Sweden, where 15% of transactions are made with cash, government regulators admit “they hadn’t predicted that the decline of cash use would prompt so many retailers or service providers to stop accepting cash, including their hospital network”.

The sudden increase in cashlessness in Sweden saw the government introduce legislation in late November to protect cash supplies.

The shift away from using cash saw bank branches across the country shut, leading to the formation of a campaign named Kontantupproret (Cash Rebellion or Cash Uprising). The campaign advocated for the protection of physical cash due to the number of people who were cut off from accessing money.

Pro: easier to travel

International travel would be easier without paper currency to change, and retailers could benefit too. Businesses currently “need to store the money, get more when they run out, and deposit cash when they have too much on hand”, said The Balance.

By embracing a cashless system, moving physical money around and protecting large sums of cash “could become a thing of the past”, the US personal finance site concluded.

Con: digital banking is ‘vulnerable’

Which? has reported concerns about the vulnerability of digital banking.

Analysis by the consumer group found that British banks were being hit by IT or security failures that prevented customers from making payments at an average rate of more than once a day, reported The Guardian.

However, advances such as biometrics – defined by Unbiased.co.uk as being “where individual physical and behavioural characteristics are measured and analysed” – are increasingly making copying and fraud difficult.

Pro: avoids ‘germy’ money

Research by Merchant Machine, the payment comparison website, revealed just how grubby cash can be. The old-school £5 note was found to be the dirtiest UK banknote, picking up 153,000 kinds of bacteria in five years of circulation.

Some of the “nasties” found on paper fivers included “Bacillus Pumilus, Coliforms, Listeria and Yeast”, which can cause “symptoms including diarrhoea, stomach cramps and vomiting”, said Yahoo.

“We all touch money on a day-to-day basis without much thought as to where it has been or who has handled it before,” Dr Richard Hastings, an expert in microbiology and healthcare regulation, told the news site.

Con: easier to budget with cash

Those opposed to a cashless society have also raised fears that using electronic payments rather than cash could increase consumer debt. “With electronic payments, it’s easy to swipe, tap, or click without noticing how much you spend. Consumers will need to renew their efforts to manage spending,” said The Balance.

Sian Williams, from the charity Toynbee Hall, said that the cost-of-living crisis has highlighted the important role cash plays as a “budgeting tool”.

“Cash is still the only way to pay which guarantees avoiding unintended debt,” she told The Telegraph.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

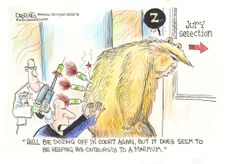

Today's political cartoons - April 20, 2024

Today's political cartoons - April 20, 2024Cartoons Saturday's cartoons - papal ideas, high-powered debates, and more

By The Week US Published

-

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Citibank to cut off online access for customers who don't go paperless

Citibank to cut off online access for customers who don't go paperlessSpeed Read The bank will shut off the customer's access to both their online website and mobile app

By Justin Klawans, The Week US Published

-

Mini-budget one year on: how the Truss-Kwarteng growth plan lingers

Mini-budget one year on: how the Truss-Kwarteng growth plan lingersThe Explainer Commentators say 'moron premium' has subsided but UK 'still stuck in first gear'

By Chas Newkey-Burden Published

-

First Republic: will UK banks survive unscathed?

First Republic: will UK banks survive unscathed?Under the Radar US shares dip after collapse of third regional bank, but experts say contagion to the UK is unlikely

By Arion McNicoll Published

-

Banking crisis: has the city weathered the financial storm?

Banking crisis: has the city weathered the financial storm?Talking Point The financial storm appears to have abated, but no one’s ruling out more squalls along the way

By The Week Staff Published

-

Should the UK relax bank ring-fencing rules?

Should the UK relax bank ring-fencing rules?Talking Point Treasury minister said he hopes to ‘boost competitiveness’ in the City with easing of regulations

By Richard Windsor Published

-

Britain's Liz Truss tries to calm markets, save her job with new treasury secretary, budget U-turn

Britain's Liz Truss tries to calm markets, save her job with new treasury secretary, budget U-turnSpeed Read

By Peter Weber Published

-

Liz Truss and Kwasi Kwarteng’s supply-side reforms

Liz Truss and Kwasi Kwarteng’s supply-side reformsfeature PM and chancellor are banking on cuts to regulations and tax in bid to stimulate growth

By The Week Staff Published

-

Should benefits rise with inflation?

Should benefits rise with inflation?Talking Point Liz Truss reportedly preparing to break predecessor’s promise as insiders warn move would be ‘politically unstainable’

By The Week Staff Published