UK audit giants ‘should be broken up’

MPs recommend Big Four accountancy first be separated into audit and non-audit businesses

Britain’s Big Four accountancy firms should be broken up, according to a scathing report from MPs which claims the firms have a stranglehold over the audit market which has contributed to serious corporate failures.

KPMG, Deloitte, PwC and EY conducted the audits at all but one of the UK’s 100 biggest listed companies last year. At the same time they offer consultancy services to these same firms, prompting questions of impartiality.

All four are currently under review by the Competitions and Markets Authority (CMA), which proposed an internal split between the two functions. The competition watchdog has also called for FTSE 350 firms to have their books looked at by more than one auditor, one of which would have to be from outside the Big Four.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Now MPs have gone a step further. In what The Guardian describes as a “hard-hitting” report, the business, energy and industrial strategy (Beis) committee has called for a full structural break-up of the firms into separate audit and consulting arms.

“The big four’s dominance has fostered a precarious market which shuts out challengers and delivers audits which investors and the public cannot rely on,” said Rachel Reeves MP, the Labour chair of the committee.

Their break-up would make the firms more effective in “tackling conflicts of interest” and providing the “professional scepticism” needed to deliver high-quality audits, the committee added.

The Daily Telegraph says the radical plan follows “extensive criticism of the sector for its failure to anticipate and flag up a number of scandals including the collapses of Government contractor Carillion and department store chain BHS, and a black hole discovered in Patisserie Valerie’s books”.

A scathing report from the department for business, energy & industrial strategy and work and pensions committees accused the Big Four of being “complicit” in Carillion’s collapse, arguing firms were putting their own profits ahead of good governance at the companies they were auditing.

The Financial Reporting Council (FRC) announced on Tuesday it had opened its own investigation into KPMG’s audit of Carillion.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

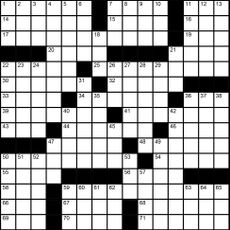

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine printables - May 3, 2024

Magazine printables - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published