Self-employed workers face pension time-bomb

Two-thirds have no retirement savings, compared to less than a third of employed workers

Self-employed workers face penury in retirement, with almost two-thirds failing to save for a pension, according to a new survey.

The report from investment firm Fidelity has revealed that 62% of self-employed people have no pension, compared with 32% of employed workers.

“Business owners and sole traders typically have unpredictable incomes,” says The Times, “meaning they may not have any money to spare for pension contributions in some years, but would want to make extra in years where they turn a big profit. Others might pay a large amount into a pension using the profits from selling their business”.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, changes to pension rules introduced in 2011 aimed at curbing tax perks for the super-rich has dramatically cut the annual amount that can be paid into a pension and still be eligible for tax relief.

This means self-employed workers could be hit with huge tax bills if they exceed annual contribution levels.

This matters because the number of self-employed workers in Britain has boomed over the past two decades, rising from three million to almost five million since the turn of the century.

“Tot only are they at risk of being caught out by the pension rules, they are also excluded from auto-enrolment, the government scheme introduced in 2012 that forces employed workers to save into a pension,” says the Times.

Since 2012, about ten million people have been swept into workplace pension schemes by their employers, thanks to automatic enrolment.

Self-employed workers also miss out on the minimum 3% earnings top-ups paid by employers.

Describing the situation as a “time-bomb”, the Financial Times said in December that “the big gap in pension provision is a growing concern for policymakers”.

It has prompted a series of new proposals from the government, including plans to use behavioural nudges and marketing tactics to raise awareness of pensions savings among the self-employed.

“However, some believe the government should have gone further and implemented a system where the self-employed are effectively automatically enrolled into a pension plan, via the tax system, unless they opt out,” says the FT. “Extending automatic enrolment to the self-employed was an election commitment, made by the government in 2017, but it believes it is not ‘straightforward’ to deliver on this pledge,” says the paper.

It means that while the government remains committed to investigating how to help self-employed workers save more for retirement, says Money Week, “any change to the pension system looks a long way off”.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

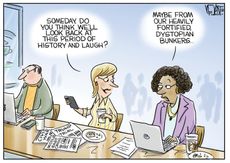

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published

-

State pension underpayments: are you getting the right amount?

State pension underpayments: are you getting the right amount?feature Hundreds of thousands of women may have received less than they were owed

By Rebekah Evans Published

-

Early retirement: what is the ‘FIRE’ movement?

Early retirement: what is the ‘FIRE’ movement?feature Younger workers are aiming to quit the workforce early through extreme saving and investment

By Rebekah Evans Published

-

How women can bridge the gender pension gap

How women can bridge the gender pension gapIn Depth New figures have shown the extent of the problem for women in retirement years

By Rebekah Evans Published

-

How to plug the pension gap by buying National Insurance credits

How to plug the pension gap by buying National Insurance creditsfeature A temporary change in the state pension offers a ‘golden opportunity’

By Marc Shoffman Last updated

-

Are UK pensions safe?

Are UK pensions safe?Today's Big Question Bank of England governor says its debt market support must end – but the multi-billion-pound scheme could be extended

By Sorcha Bradley Published

-

Pensions: time to end the triple lock?

Pensions: time to end the triple lock?Why Everyone’s Talking About Ministers must decide whether to risk alienating older voters by ending guaranteed pension rises

By The Week Staff Published

-

Brits keeping 21 million ‘money secrets’ from friends and family, survey reveals

Brits keeping 21 million ‘money secrets’ from friends and family, survey revealsSpeed Read Four in ten people admit staying quiet or telling fibs about debts or savings

By Joe Evans Last updated

-

London renters swap cramped flats for space in suburbia

London renters swap cramped flats for space in suburbiaSpeed Read New figures show tenants are leaving Britain's cities and looking to upsize

By The Week Staff Published