Millennials ‘misjudging inheritance windfall’

Survey finds some young people have unrealistic expectations of the amount of money they will inherit and what it could buy

The majority of millennials are misjudging the amount of inheritance they will receive and when they expect to get it, wealth manager Charles Stanley has found.

Their new survey suggests young people on average expected to receive nearly £130,000 from relatives when they die, when if fact the median amount handed down was only £11,000

Similarly, one in seven millennials expected to inherit the month before they turned 35, although in reality the typical inheritance age is between 55 and 64.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are also unrealistic expectations about what an inheritance can go towards. At least 22% of millennials planned to use any money to go towards a deposit on a house, although official statistics suggest only 7% actually did so.

“People are living longer than ever, so relying on an inheritance to get on the housing ladder is a risky strategy as you may get less, and much later than planned,” said John Porteous, from Charles Stanley.

“In reality, most people save and invest to get on the housing ladder. Starting early and planning ahead is essential to achieving the deposit you need,” he added.

“Having said that, more people are inheriting,” says Your Money. Inheritance tax receipts in the UK hit a record high of £5.4bn in the 2018-19 tax year, up £164m or 3.1% on the previous 12 months, which was also a record.

The Financial Times says “many professional advisers and financial services companies have been quick to point out that this is a result of many families failing to do sensible planning to reduce or avoid the tax”.

“While that may be true to an extent, it also reflects the fact that assets, particularly housing, have grown substantially in value over the past decade,” says the paper.

This has prompted concern many in the UK are neglecting planning for death, with up to 30 million people currently without a written will.

Separate findings from Canada Life published this week reveal a staggering 63% of people aged 45 and over have not told their beneficiaries how much inheritance they plan to leave them.

“The shock figure highlights an ongoing uncertainty of how much money is really needed to fund later life and confusion surrounding how inheritance tax works,” says the Daily Express. A huge concern for over-45s is using all their assets to fund their retirement, with 39% worried they will have nothing left to give their family.

The BBC report the government “is planning to substantially increase the cost to bereaved families of settling the estates of deceased relatives”, however, the changes which were expected to start last month have been delayed.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

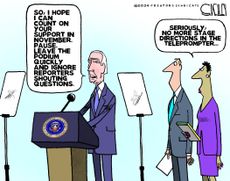

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

The great wealth transfer: who stands to gain?

The great wealth transfer: who stands to gain?Under the radar Millennials are forecast to inherit a fortune but are they qualified to handle sudden riches?

By Chas Newkey-Burden, The Week UK Published

-

Brits keeping 21 million ‘money secrets’ from friends and family, survey reveals

Brits keeping 21 million ‘money secrets’ from friends and family, survey revealsSpeed Read Four in ten people admit staying quiet or telling fibs about debts or savings

By Joe Evans Last updated

-

London renters swap cramped flats for space in suburbia

London renters swap cramped flats for space in suburbiaSpeed Read New figures show tenants are leaving Britain's cities and looking to upsize

By The Week Staff Published

-

Should the mortgage holiday scheme have been extended?

Should the mortgage holiday scheme have been extended?Speed Read Banks warn that some homeowners may struggle to repay additional debt

By The Week Staff Last updated

-

RBS offers coronavirus mortgage holidays

RBS offers coronavirus mortgage holidaysSpeed Read Taxpayer-owned bank follows measures taken in virus-struck Italy

By The Week Staff Last updated

-

What are the changes to National Savings payouts?

What are the changes to National Savings payouts?Speed Read National Savings & Investments cuts dividends and prizes for bonds

By The Week Staff Published

-

‘Colonial relic’: why eight African countries have severed currency ties with France

‘Colonial relic’: why eight African countries have severed currency ties with FranceSpeed Read Former French colonies to replace the CFA franc with the eco

By The Week Staff Published

-

China clears path to new digital currency

China clears path to new digital currencySpeed Read Unlike other cryptocurrencies, Beijing’s would increase central control of the financial system

By Elliott Goat Last updated