How would Italy’s ‘parallel currency’ work?

Deputy prime minister hints at nuclear fiscal option in defiant riposte to EU ultimatum

The Italian government is set to face off with the EU after threatening of launching a “parallel currency” in a riposte to calls for it to rein in its public spending programme.

Facing €3.5bn in fines from the EU for failing to tighten its fiscal belt, the far-right League which is part of the ruling coalition has adopted a strategy which “is to offer EU leaders a choice: reform the EU treaties to enable fiscal expansion and allow the European Central Bank to act as lender-of-last-resort; or face the consequences”, writes Ambrose Evans-Pritchard in The Daily Telegraph.

Fresh from an emphatic European election victory in which his party swept up nearly 40% of the vote in Italy, League leader and deputy prime minister Matteo Salvini struck a defiant tone, saying “I don’t govern a country on its knees”.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

His answer is to revive the threat of introducing so-called “mini-BOTs”, named after Italy’s short-term Treasury bills, which would act as a form of parallel currency in competition with the euro.

Reuters says the Treasury “would print billions of euros of non-interest-bearing, tradeable securities which could then be used by recipients to pay taxes and buy any services or goods provided by the state, including, for example, petrol at stations run by state-controlled oil company ENI”.

Claudio Borghi, Lega chairman of Italy’s house budget committee and long-time critic of the euro, said the plan for minibot treasury notes is written into the coalition’s solemn “contract” and will be activated to flank the tax reform package.

“It is a way to mobilise credit that is badly needed and put money into circulation,” he said.

“This scrip paper creates parallel liquidity - akin to what [former Greek finance minister] Yanis Varoufakis wanted to do in Greece - to be used to pay €50bn of arrears to state contractors and households”, says Evans-Pritchard.

“Once these short-term notes trade on the open market they would become a de facto currency, a new lira in waiting. Italy would have a split monetary system. The euro would unravel from within,” he writes.

Supporters of the plan say it will “finally resolve the intractable problem of the state’s outstanding bills, which has weighed on Italy’s economy for years. They say that by providing money for consumers to spend and companies to invest, it can give a major boost to the country’s sluggish economy”, Reuters says.

However, “the impact on public finances is disputed” says the news agency. “Critics say it will raise Italy’s public debt, already the highest in the euro zone after Greece’s.”

“Italy might be able to use mini-BOTs (or let’s be honest and call them the new lira) to finance deficit spending without breaking eurozone rules” John Mauldin said in Forbes last summer when the idea of a parallel currency was first touted.

“This could ultimately debase the euro and blow apart the eurozone. Germany would have to leave. From there, you can draw your own map,” he added.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

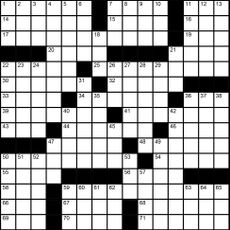

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Geopolitics and the economy in 2024

Geopolitics and the economy in 2024Talking Point The West is banking on a year of falling inflation. Don't rule out a shock

By The Week UK Published

-

US-led price cap on Russian oil 'almost completely circumvented'

US-led price cap on Russian oil 'almost completely circumvented'Speed Read 'Almost none' of seaborne crude oil from Moscow stayed below $60 per barrel limit imposed by G7 and EU last year

By Harriet Marsden, The Week UK Published

-

Mexico's Sinaloa cartel bans fentanyl, reportedly under pain of death

Mexico's Sinaloa cartel bans fentanyl, reportedly under pain of deathSpeed Read The top exporter of fentanyl to the U.S. is apparently looking to diversify as law enforcement turns up the heat

By Peter Weber, The Week US Published

-

The threat posed by bonds to the global financial system

The threat posed by bonds to the global financial systemUnder The Radar The worst bear market in a century is unleashing huge strain on parts of the financial system

By The Week Staff Published

-

China: a superpower’s slump

China: a superpower’s slumpThe Explainer After 40 years of explosive growth, China’s economy is now in deep distress — with no turnaround in sight

By The Week Staff Published

-

Silvio Berlusconi’s death triggers real-life Succession drama

Silvio Berlusconi’s death triggers real-life Succession dramafeature How the five children of Italy’s former prime minister will divide his estate and business assets is a matter of much speculation

By Richard Windsor Published

-

Are Western sanctions working on Russia’s growing economy?

Are Western sanctions working on Russia’s growing economy?Today's Big Question IMF forecasts Russian growth but one expert says the West must be patient in bid to deter Putin

By Arion McNicoll Published

-

South Africa’s energy crisis explained

South Africa’s energy crisis explainedfeature Electricity blackouts lead to rising crime and economic hardship and add to pressure on ANC

By The Week Staff Published