Mortgage approvals leap to the highest level for five years

December's healthy figures couldn't stop an overall fall for 2019

The number of mortgages approved jumped to its highest level for almost five years in December.

In what The Guardian describes as “the latest sign of a revival in the housing market”, mortgage approvals for house purchases increased to 46,815 in December compared with 44,058 a month earlier – the highest level since April 2015.

UK Finance, the trade body that represents major high street banks, said the value of mortgage lending increased the most since March 2016, rising by a net £3.8bn.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, as City AM points out, mortgage lending in the UK actually fell in 2019 overall.

“Transaction levels and overall lending volumes in 2019 were still low by historical standards, but in the circumstances they held up exceptionally well,” remarked Sam Harhat, head of financial services at Andrews Property Group.

Howard Archer, the chief economic adviser to the EY Item Club, said mortgage approvals were probably lifted by an uptick in confidence and political certainty after the December general election.

“Prior to November, mortgage approvals for house purchases had fallen back for three successive months to be at a seven-month low in October, indicating that activity was being pressurised by heightened uncertainties over the domestic political situation and Brexit,” he said.

There could be more good news on the horizon, according to Samuel Tombs, chief UK economist at Pantheon Macroeconomics. He said the “additional boost to approvals from the result of the general election still is to come”.

Ben Johnston, director of Houso, the off-market property app, told Yahoo: “The market is moving in the right direction... but more emphasis is also needed on the government sorting out stamp duty in the budget.”

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

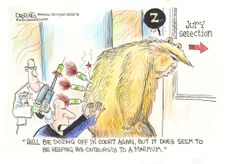

Today's political cartoons - April 20, 2024

Today's political cartoons - April 20, 2024Cartoons Saturday's cartoons - papal ideas, high-powered debates, and more

By The Week US Published

-

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

2023: the year of sticker shock

2023: the year of sticker shockThe Explainer Many Americans were down on the economy this year due to problematic prices

By Justin Klawans, The Week US Published

-

Interest rates: more ‘trauma’ for households

Interest rates: more ‘trauma’ for householdsTalking Point Latest hike will cause ‘plenty of pain for borrowers’

By The Week Staff Published

-

UK house prices fall at fastest rate for nearly 14 years

UK house prices fall at fastest rate for nearly 14 yearsSpeed Read First-time buyers may welcome the news but higher than expected inflation means mortgage costs remain an issue

By Jamie Timson Published

-

How will recession affect the UK?

How will recession affect the UK?Today's Big Question Inflation set to hit 13% by end of year as UK on course for recession, warns Bank of England

By The Week Staff Last updated

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published