How Iran is using bitcoin to dodge Trump’s sanctions

Tehran government issues 1,000 cryptocurrency mining permits in bid to kickstart struggling economy

Iran is turning to cryptocurrencies in a bid to offset the damage inflicted by US sanctions as the economic war between the two nations intensifies.

Tehran is using digital coins to avoid transactions through traditional banks, and also hopes to cash in on the gains traditionally made by such currencies when traditional markets falter.

The value of leading digital currency bitcoin has soared by almost 30% since the start of the year, as the coronavirus outbreak triggers slumps in global stock and oil markets, reports The Times.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What are the US sanctions?

Sanctions placed on Iran’s energy, shipping and financial sectors by Donald Trump after the US president abandoned a nuclear deal in 2018 effectively banned foreign companies, territories and states from trading with or investing in the Middle Eastern country.

US companies are barred from doing deals not only with Iran, but also with other countries or foreign firms that do so.

In May last year, Trump ended exemptions from US secondary sanctions - such as exclusion from US markets - for major importers of Iranian oil, reports the BBC.

He said the move, combined with further restrictions on the banking sector, was “intended to bring Iran’s oil exports to zero, denying the regime its principal source of revenue”.

And the effect on Iran?

The value of Iran’s currency, the rial, has halved since Trump first began reimposing embargoes less than two years ago. Food prices are increasing and Iran’s foreign currency reserves have shrunk by 20% since 2013.

The recession-hit country’s GDP contracted by 4.8% in 2018 and by an estimated 9.5% in 2019, according to the International Monetary Fund, which is forecasting zero growth this year.

Living costs in Iran have risen dramatically, with inflation climbing from 9% in 2017 to an estimated 30.5% in 2018 and 35.7% in 2019.

The price of meat has increased by 116%, with overall food and drink prices up 61% year-on-year.

Last November, the government announced that it would be cutting petrol subsidies, causing the cost to rise by 50%, and banning drivers of private cars from purchasing more than 60 litres a month.

The move proved to be the breaking point for many Iranians, hundreds of thousands of whom took to the streets in cities nationwide to protest. In response, government security forces launched a brutal crackdown that left at least 208 people dead and thousands more injured, according to Amnesty International.

How are cryptocurrencies used to avoid sanctions?

Unlike traditional currencies, cryptocurrencies exist only in digital form. There is no central bank, and payments do not go through the Swift system that other banks use to share information, so regulators can’t monitor or block transactions.

“The system is designed explicitly to avoid central banks and large financial institutions,” says The New York Times. “With Bitcoin and other cryptocurrencies, there is simply no way to duplicate the banking sanctions that have proved so damaging to the Iranian economy.”

Iranians are also taking advantage of their country’s cheap power rates to “mine” cryptocurrencies - using computers to solve complex equations that verify transactions made with cryptocurrencies and group them in a secure “blockchain”, in return for payment with new coins.

In most countries, the cost of the electricity needed to power the computers is greater than the value of the mined bitcoin. But Iran has some of the lowest electricity prices in the world - 0.5p per kilowatt hour, compared with an average of 14.4p in the UK, according to The Times.

Last week, Iran’s Ministry of Industry, Mining and Trade issued 1,000 new cryptocurrency mining permits in the hope of generating billions of dollars worth of currency to bolster the Iranian economy. The Iranian Information and Communications Technology Guild estimates that the move could generate $8.5bn (£6.5bn).

“If a country is mining cryptocurrency, it can stockpile it,” Kayla Izenman, a cryptocurrencies analyst at London’s Royal United Services Institute think-tank, told The Times. “It’s volatile but it will keep at least some of its value.”

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

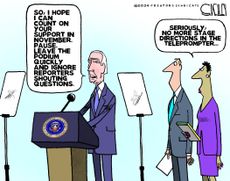

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

Justices set to punt on Trump immunity case

Justices set to punt on Trump immunity caseSpeed Read Conservative justices signaled support for Trump's protection from criminal charges

By Peter Weber, The Week US Published

-

'Biden is smart to keep the border-security pressure on'

'Biden is smart to keep the border-security pressure on'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Arizona grand jury indicts 18 in Trump fake elector plot

Arizona grand jury indicts 18 in Trump fake elector plotSpeed Read The state charged Mark Meadows, Rudy Giuliani and other Trump allies in 2020 election interference case

By Peter Weber, The Week US Published

-

'Voters know Biden and Trump all too well'

'Voters know Biden and Trump all too well'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Who will win the 2024 presidential election?

Who will win the 2024 presidential election?In Depth Election year is here. Who are pollsters and experts predicting to win the White House?

By Justin Klawans, The Week US Published

-

National Enquirer helped Trump in 2016, ex-boss says

National Enquirer helped Trump in 2016, ex-boss saysSpeed Read David Pecker says the tabloid published fabricated content to hurt Trump's rivals

By Peter Weber, The Week US Published

-

Sitting in judgment on Trump

Sitting in judgment on TrumpOpinion Who'd want to be on this jury?

By Susan Caskie Published

-

Israel hits Iran with retaliatory airstrike

Israel hits Iran with retaliatory airstrikeSpeed Read The attack comes after Iran's drone and missile barrage last weekend

By Peter Weber, The Week US Published