HSBC to cut 35,000 jobs: why profits plunged

British bank announces 33% drop in profits and plans to slash branches in US

British bank HSBC has announced a steep fall in profits and warned it will now cut 35,000 of its 235,000-strong global workforce. It is not known how many jobs will go in the UK.

Founded as the Hong Kong and Shanghai Banking Corporation in the mid-19th century, HSBC makes most of its profit in Asia, despite being headquartered in London. Most of the drop in profits has come from its European operations.

What happened to profits?

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Annual profit before tax for 2019 fell by 33% on the previous year, down to $13.35bn (£10.3bn), the bank reported. In the fourth quarter, HSBC made a loss of $3.9bn (£3bn), the Financial Times reports.

What drove the poor results?

The loss was largely due to a $7.2bn (£5.5bn) write-off in HSBC’s European investment and commercial banking operations. As such, it was not unexpected. The bank blamed it on “lower long-term economic growth rate assumptions”, notes the FT.

Factors behind the European problems include historically low interest rates worldwide and lower growth caused by the UK’s protracted exit from the EU, says the BBC.

Banking expert Peter Hahn, however, told the broadcaster he believed HSBC had been “too optimistic about their chances of success in investment banking” and lacked clout in the US.

What about coronavirus?

The rapidly spreading virus will have an impact on HSBC’s performance this year, commentators agree, but the current figures relate to last year. Covid-19 was identified in Wuhan, China, only in December 2019.

What will the bank do next?

HSBC today announced its third major restructure in a decade in an attempt to lift future profits. It plans to sell assets totalling $100bn (£77bn) and “dramatically downsize” its investment banking operations in a bid to save $4.5bn (£3.5bn) a year, says City AM.

Interim chief executive Noel Quinn told Reuters that HSBC will cut its global workforce by 15% or 35,000 – reducing the total from 235,000 to 200,000 – over the next three years. It is not known how many jobs might go in the UK but the BBC says the job losses are “deeper” than the 10,000 analysts had predicted. Around 40,000 people work for the bank in the UK.

Quinn said job losses would be achieved partly through natural attrition, and redundancies would be “managed in a sensible and sensitive manner”. In the US, HSBC has committed to cutting one third of its retail branches.

How did the markets react to the rescue plan?

Not well, says the FT. HSBC’s share price dropped 6% in early trading in London this morning. Some investors were disappointed HSBC was planning to prioritise its growth in Asia and other emerging markets, reports the newspaper.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The hunt for Planet Nine

The hunt for Planet NineUnder The Radar Researchers seeking the elusive Earth-like planet beyond Neptune are narrowing down their search

By Chas Newkey-Burden, The Week UK Published

-

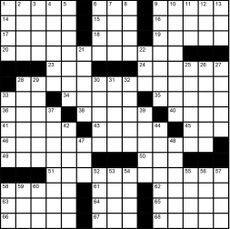

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Citibank to cut off online access for customers who don't go paperless

Citibank to cut off online access for customers who don't go paperlessSpeed Read The bank will shut off the customer's access to both their online website and mobile app

By Justin Klawans, The Week US Published

-

First Republic: will UK banks survive unscathed?

First Republic: will UK banks survive unscathed?Under the Radar US shares dip after collapse of third regional bank, but experts say contagion to the UK is unlikely

By Arion McNicoll Published

-

Banking crisis: has the city weathered the financial storm?

Banking crisis: has the city weathered the financial storm?Talking Point The financial storm appears to have abated, but no one’s ruling out more squalls along the way

By The Week Staff Published

-

The Silicon Valley Bank collapse

The Silicon Valley Bank collapsefeature Sudden failure of tech sector’s go-to bank sparks fears of wider contagion

By The Week Staff Published

-

Should the UK relax bank ring-fencing rules?

Should the UK relax bank ring-fencing rules?Talking Point Treasury minister said he hopes to ‘boost competitiveness’ in the City with easing of regulations

By Richard Windsor Published

-

Should caps on bankers’ bonuses be scrapped?

Should caps on bankers’ bonuses be scrapped?Talking Point New chancellor Kwasi Kwarteng believed to be planning contentious move to ‘boost the City’

By Chas Newkey-Burden Published

-

Making money: space diamonds and meteorite collecting

Making money: space diamonds and meteorite collectingfeature ‘The Enigma’ black diamond is expected to sell at auction for £5m

By Mike Starling Published

-

Investing in China: what do the experts think?

Investing in China: what do the experts think?feature Some have been predicting a full-scale ‘China crisis’ for years, while others are spying opportunities

By The Week Staff Last updated