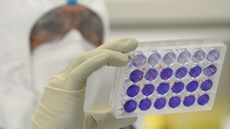

How coronavirus has hit the financial markets

The market is entering the period of ‘peak fear’

Stock markets around the world are having their worst week since the 2008 global financial crisis amid fears over the impact of the coronavirus outbreak.

Investors are concerned that the spread of the coronavirus could spark a global recession, with many key global market indexes - including the FTSE 100 and the Dow Jones - falling 10% from recent peaks.

As of this morning, nearly 84,000 cases of coronavirus have been reported worldwide and 2,859 people have died from the virus.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What has happened to the markets Europe?

The news of the virus’s rapid spread in Europe, notably in northern Italy, has sparked concerns of a much more damaging economic effect than previously expected, says the BBC.

European markets dropped sharply this morning, with London’s FTSE 100 index sinking more than 3%.

All the big European share indexes saw large falls at the start of trading today. Germany’s Dax index opened down 3.6%, while France’s Cac 40 index fell 3.1%.

The Bank of England governor Mark Carney has warned that spread of the coronavirus could lead to the UK’s economic growth prospects being downgraded.

“What we are picking up with some of our bigger companies and companies around the world is that supply chains... are getting a little tight. That’s lower activity,” he told Sky News.

“There’s less tourism - as you can see on our streets here in the UK. That's lower activity as well. We would expect world growth would be lower than it otherwise would be, and that has a knock-on effect on the UK.”

The central bank is constantly monitoring UK banks to ensure they remain in good health, Carney said. He added that while it is “too early to tell what it means for the UK, or its magnitude… the system is functioning. We’re very confident about that, and we're on top of it.”

Airlines are some of the companies hit worst by the outbreak of the virus. IAG, which owns British Airways, said business travel has been hit by the cancellations of various trade fairs, and corporate travel restrictions, reports The Guardian.

“Global stocks have entered correction territory and it’s now that we can start to consider the market is entering the period of peak fear,” says Neil Wilson, chief market analyst at Markets.com.

–––––––––––––––––––––––––––––––For a round-up of the most important stories from around the world - and a concise, refreshing and balanced take on the week’s news agenda - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––

What about the rest of the world?

Asian markets have suffered another drop after weeks of falling and flatlining. Japan’s Nikkei 225 index fell 3.7%, leaving it more than 9% down for this week. China’s Shanghai Composite index also fell 3.7% on Friday.

In the US, the Dow Jones recorded its biggest daily points drop yesterday.

US tech giants Apple and Microsoft have both warned that their businesses will take a hit from the impact of the virus, while US investment bank Goldman Sachs said yesterday that the virus will wipe any growth in company profits this year.

Mayank Mishra, a strategist at Standard Chartered Bank, said: “Previously the market had taken some comfort in the falling infection rates in China as a result of containment measures put in place earlier.

“But the spread of the coronavirus infection outside China, with clusters emerging in South Korea, Italy and Japan, has increased concerns significantly.”

Oil prices have also plummeted amid concerns the virus will lead to a big drop in demand. The price of Brent crude fell nearly 3% to $50.31 (£38.79) a barrel on Friday morning, its lowest price for over a year.

Amid the market chaos, one company could avoid taking a hit. 3M (MMM) is one of the largest producers of N95 respirators, the type of mask that more efficiently protects people against the virus than ordinary medical masks, says CNN.

This week, investment analysts Melius Research upgraded its rating on 3M stock to a buy.

“The simple reality is that 3M is one of only a handful of S&P names that sells a necessary product in virus containment,” according to the Melius report. “This is being ignored by the market.”

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

What are the rules on cutting sick pay for unvaccinated staff?

What are the rules on cutting sick pay for unvaccinated staff?feature Ikea joins growing list of firms axing sick pay entitlement for employees who haven’t had Covid jabs

By The Week Staff Published

-

The Bank of England official warning women against home working

The Bank of England official warning women against home workingWhy Everyone’s Talking About Not returning to the office will result in ‘two track’ career development, senior policymaker claims

By The Week Staff Published

-

Valneva vaccine: why UK ditched jab with ‘stronger immune response’ than AstraZeneca

Valneva vaccine: why UK ditched jab with ‘stronger immune response’ than AstraZenecaIn Depth Downing Street accused French manufacturer of breaching contract

By Julia O'Driscoll Published

-

End of the furlough scheme: what happens next for the UK’s job market?

End of the furlough scheme: what happens next for the UK’s job market?Business Briefing 1.6m workers were still being supported by the scheme in July

By The Week Staff Published

-

UK travel industry ‘choked’ by Covid restrictions

UK travel industry ‘choked’ by Covid restrictionsfeature Seven in ten firms planning redundancies as holiday bookings collapse

By The Week Staff Published

-

Leaked government report reveals what post-Freedom Day restrictions could cost UK

Leaked government report reveals what post-Freedom Day restrictions could cost UKUnder the Radar England set to drop face masks and social distancing from 19 July

By The Week Staff Published

-

Freedom Day delay: ‘catastrophic’ for businesses on life support

Freedom Day delay: ‘catastrophic’ for businesses on life supportfeature Billions to be wiped from economy and Sunak rejects calls to extend furlough scheme

By Mike Starling Published

-

‘The man who saved the world’: is AstraZeneca’s boss worth his millions?

‘The man who saved the world’: is AstraZeneca’s boss worth his millions?Today's Big Question Pascal Soriot’s bonus might be deserved, but that doesn’t mean it’s necessarily wise

By The Week Staff Published