Why are banks blocking lost holiday repayments?

Lenders are stalling on refunds as tourists are owed £7bn for cancelled trips

Disappointed holidaymakers, trying to get their money back for trips disrupted by the coronavirus pandemic, are having their refund applications blocked by banks and credit card operators.

Tourists are currently owed an estimated £7 billion for unused holidays and flights but travel operators are offering credit notes or deferred bookings instead.

However, many customers are unwilling to accept either offer because they fear that the notes will be worthless if the companies go bust, or because they cannot travel at a later date.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Times says that tourists and the travel industry both want the government to step in to guarantee the notes but ministers have failed to act.

Therefore, thousands of travellers have turned to their banks and card operators, who are legally obliged under Section 75 of the Consumer Credit Act, to refund eligible customers.

Customers who booked their holidays or flights on a credit card can legally claim back the cost from their bank if the cancellation constitutes a breach of contract.

But some are being told that they are either not eligible or that they must exhaust all avenues with their travel company first, which is not required in law.

–––––––––––––––––––––––––––––––For a round-up of the most important stories from around the world - and a concise, refreshing and balanced takeon the week’s news agenda - try The Week magazine. Start your trial subscription today –––––––––––––––––––––––––––––––

Some banks are also blocking their customers from making “chargeback” claims.

Customers of several lenders, including Halifax, Metro Bank and RBS, say that they have been told they are not eligible because they have been offered credit notes. This approach contradicts the guidance issued by Visa and Mastercard.

Amid anger over the stalling tactics, the Financial Ombudsman Service, which adjudicates on complaints between banks and their customers, said: “We recognise this is an unprecedented situation but there is no reason not to process these claims as usual.”

Banking bosses say that the issues are “cock up rather than conspiracy” but Gareth Shaw, of Which?, said: “There needs to be greater clarity and consistency about claiming through banks, and the industry should ensure that all customers have a fair chance of getting their money back.”

Last week, Which? accused UK travel operators of breaking the law by refusing to pay out in 14 days. It suggested “extending the processing deadline to 28 days” and for any vouchers to be “guaranteed against insolvency and eventually redeemable for cash”.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The hunt for Planet Nine

The hunt for Planet NineUnder The Radar Researchers seeking the elusive Earth-like planet beyond Neptune are narrowing down their search

By Chas Newkey-Burden, The Week UK Published

-

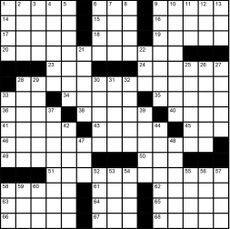

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

The birth of the weekend: how workers won two days off

The birth of the weekend: how workers won two days offThe Explainer Since the 1960s, there has been talk of a four-day-week, and post-pandemic work patterns have strengthened those calls

By Chas Newkey-Burden, The Week UK Published

-

Citibank to cut off online access for customers who don't go paperless

Citibank to cut off online access for customers who don't go paperlessSpeed Read The bank will shut off the customer's access to both their online website and mobile app

By Justin Klawans, The Week US Published

-

Why household wealth took off during the pandemic

Why household wealth took off during the pandemicUnder The Radar The Covid-19 pandemic caused a lot of pain and hardship, but new research shows it also left most Americans wealthier

By Justin Klawans, The Week US Published

-

Empty office buildings are blank slates to improve cities

Empty office buildings are blank slates to improve citiesSpeed Read The pandemic kept people home and now city buildings are vacant

By Devika Rao Published

-

Inflation vs. deflation: which is worse for national economies?

Inflation vs. deflation: which is worse for national economies?Today's Big Question Lower prices may be good news for households but prolonged deflation is ‘terrible for the economy’

By The Week Staff Published

-

First Republic: will UK banks survive unscathed?

First Republic: will UK banks survive unscathed?Under the Radar US shares dip after collapse of third regional bank, but experts say contagion to the UK is unlikely

By Arion McNicoll Published

-

Banking crisis: has the city weathered the financial storm?

Banking crisis: has the city weathered the financial storm?Talking Point The financial storm appears to have abated, but no one’s ruling out more squalls along the way

By The Week Staff Published

-

America's 'cataclysmic' drop in college enrollment

America's 'cataclysmic' drop in college enrollmentToday's Big Question "The slide in the college-going rate since 2018 is the steepest on record"

By Peter Weber Published