Is private equity taking over - and is that a problem?

How a new strategy has reshaped the market

Before the global financial crisis, hedge funds were supposedly the masters of the universe. They amassed countless tens of billions in assets under management, enjoying juicy fees of around 2% a year plus 20% of the upside. Flash forward to last year, before coronavirus, and the hedge funds were out, replaced by private equity (PE) funds.

These private equity fund managers preserved much of the fee structure, but had a whole new strategy. They bought private businesses, frequently loaded them up on debt, cut costs, reinvested in new products or operations, and then sold these private firms on to other private equity funds or listed them on the stock market. A raft of well-known names ranging from the AA and Saga, through to Halfords, found their way on to the UK stock market via private equity owners.

The rise and rise of private equity

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

According to data firm Prequin, as of June last year, total assets under management within the private equity sector had hit a record $4.11 trillion, with hedge funds managing “just” $2.8 trillion. By contrast the total market value of all stocks listed in the US was $35 trillion. That’s a huge number by comparison with the private equity funds. But in reality, the influence of these lavishly rewarded fund managers is already pronounced and is growing year on year – or at least that was the conclusion of a report from analysts at investment bank Morgan Stanley in late 2019.

Numerous reports have already shown that the pace of growth in new businesses choosing to “go public” on stock markets has declined markedly in recent years. The Morgan Stanley analysts also noted that the level of mergers and acquisitions (M&A) activity during 2019 fell close to a historic low as a proportion of the market’s overall value. Meanwhile, on the same measure, private equity activity in Europe hit its highest level in a decade.

In simple language, private equity funds were, and are, having a disproportionate impact on public markets, especially in sectors such as media, industrials and consumer services. Many – including the Morgan Stanley analysts – see this as a positive trend, one that helps to combat the rise in perceived short-termism in public equity markets. Private equity firms also benefit from easy access to cheap credit, lowering the cost of capital significantly for many businesses, and they are also more willing to engage with businesses which have “grey exposure”(these are businesses where sustainability issues mean that many ethical investors are reluctant to commit new capital).

The life cycle of a business

The reality is that the life cycle of business development – and access to capital – has changed fundamentally in recent years. Early-stage businesses have always been more reliant on seed capital from private wealthy investors and “angels”, as well as venture capitalists. After this first stage of growth, a private business will typically seek to scale up a successful idea, product or service, often by borrowing from the bank.

As that second stage starts to produce meaningful profit margins, many growth businesses would once have sought public finding via a stock market listing. Over time, that growth would hopefully turn into solid profits, high margins and generous cashflows, which could be paid out in dividends to grateful investors. In this traditional life cycle, public markets in effect offer a trade – the business gets capital to scale up in return for generous payouts via dividends after the business has matured.

Private equity looks to upend those last two stages, causing many businesses to skip public markets altogether. If one looks at the portfolios of successful private equity firms – such as UK-based HgCapital (itself listed on the London Stock Exchange) – one will see a long list of high-growth, relatively mature businesses, with high margins and strong market positions – i.e. businesses that once would have been listed on a stock market. Many of these portfolio businesses might stay private forever, with “exits” via trade sales to other private equity outfits.

What Covid-19 means for private equity

For many market observers, these structural changes represent a challenge to the traditional investment model. Private investors are in effect unable to access these growth-orientated businesses, because most of the underlying investors in private equity funds are big institutions willing to deploy money for as long as 10 years in a partnership structure.

But even if access was entirely open to private investors – and a handful of private equity funds are in fact listed in London – there’d be real concerns about the huge amount of leverage (borrowing) built into these business models. Other stakeholders such as trade unions also frequently complain not just about high debt levels and low levels of corporate taxation (debt can be offset against corporate taxes) but also the management practices of cost-conscious private equity owners. Some (left-wing) politicians in Germany have even gone as far as to call the private equity funds “locusts”.

The sudden advent of Covid-19 might change things. Although debt levels are still rising globally, investors have grown wary about too much corporate leverage. And many of the world’s most successful businesses during the viral emergency have been high-profile technology companies with equally high-profile stock market listings.

Yet a cynic might nevertheless observe that private equity fund managers have been remarkably busy raising tens of billions for brand new “distressed” funds, ready to pounce on victims of the viral emergency. Private equity might face headwinds, but it shows no signs of going quietly into the night.

Discover more of the latest investment views and ideas from Liontrust’s experienced fund managers

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

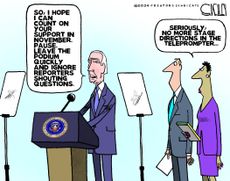

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published