Goldman and Morgan risk losing star traders

Philip Delves Broughton on what the change in status of two top investment banks will mean

The swinging times are over for investment bankers. Today's news that the last big investment banks on Wall Street, Goldman Sachs and Morgan Stanley, will become bank holding companies, subject to the same level of regulation as America's high street banks, marks an end to an extraordinary run for these institutions.

It may be a while before you can get your hands on a Goldman Sachs chequebook or take out a Morgan Stanley mortgage. But eventually, these firms, which grew rich operating at stratospheric levels of finance, will have to engage in the humdrum business of ordinary retail banking - most likely by acquiring a few of the many regional banks suffering through the subprime crisis. The Masters of the Universe will have to learn to be bank managers.

The firms requested this change themselves as a means of self-preservation in the wake of last week's chaos on Wall Street. A run by investors brought the two banks to their knees, despite being relatively sound businesses.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The immediate impact will be tighter regulation and supervision and much less risk-taking. By becoming bank holding companies, both Goldman and Morgan will have to cut the leverage they have used to make such extraordinary profits.

Goldman today has $1 of capital for every $22 of assets, while Morgan Stanley's ratio is 1:30. Bank holding companies tend to borrow closer to 10 times their capital.

The immediate advantage is that the banks will now have access to the Federal Reserve's low-interest credit lines to help them through the financial whirlwind. In the longer term, they will have the cushion of customer deposits to help them through hard times.

In recent years, the greatest profits for both firms have come from trading with their own money. While the mergers and acquisitions folk trolled for deals, it was the traders who came to rule. The change was most evident at Goldman Sachs where Lloyd Blankfein, a career trader, succeeded Hank Paulson, a classic deal-making investment banker, as chief executive in 2006. The investment banks not only competed with each other, but also with the fast-growing and less heavily regulated hedge funds for both people and profits.

Today's change will likely hasten the departure of the best traders from the banks to hedge funds, where they can earn more and operate more freely. The next step for the government will be to decide what level of regulation to impose on them.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 14, 2024

Today's political cartoons - April 14, 2024Cartoons Sunday's cartoons - Trump Derangement Syndrome, social media dangers, and more

By The Week US Published

-

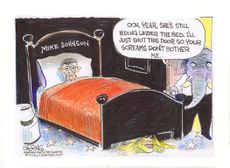

5 rambunctious cartoons about the House speakership standoff

5 rambunctious cartoons about the House speakership standoffCartoons Artists take on Mike Johnson's night terrors, the Speaker's chair, and more

By The Week US Published

-

The Week Unwrapped: Ultrarunning, menswear and a meaty row

The Week Unwrapped: Ultrarunning, menswear and a meaty rowPodcast Is the "Hardest Geezer" a high-endurance trendsetter? Will Ted Baker survive? And what's the beef with lab-grown meat?

By The Week Staff Published

-

Home Office worker accused of spiking mistress’s drink with abortion drug

Home Office worker accused of spiking mistress’s drink with abortion drugSpeed Read Darren Burke had failed to convince his girlfriend to terminate pregnancy

By The Week Staff Published

-

In hock to Moscow: exploring Germany’s woeful energy policy

In hock to Moscow: exploring Germany’s woeful energy policySpeed Read Don’t expect Berlin to wean itself off Russian gas any time soon

By The Week Staff Published

-

Were Covid restrictions dropped too soon?

Were Covid restrictions dropped too soon?Speed Read ‘Living with Covid’ is already proving problematic – just look at the travel chaos this week

By The Week Staff Last updated

-

Inclusive Britain: a new strategy for tackling racism in the UK

Inclusive Britain: a new strategy for tackling racism in the UKSpeed Read Government has revealed action plan setting out 74 steps that ministers will take

By The Week Staff Published

-

Sandy Hook families vs. Remington: a small victory over the gunmakers

Sandy Hook families vs. Remington: a small victory over the gunmakersSpeed Read Last week the families settled a lawsuit for $73m against the manufacturer

By The Week Staff Published

-

Farmers vs. walkers: the battle over ‘Britain’s green and pleasant land’

Farmers vs. walkers: the battle over ‘Britain’s green and pleasant land’Speed Read Updated Countryside Code tells farmers: ‘be nice, say hello, share the space’

By The Week Staff Published

-

Motherhood: why are we putting it off?

Motherhood: why are we putting it off?Speed Read Stats show around 50% of women in England and Wales now don’t have children by 30

By The Week Staff Published

-

Tonga’s tsunami: the aid effort turns political

Tonga’s tsunami: the aid effort turns politicalSpeed Read Efforts to help Tonga’s 105,000 residents have been beset by problems

By The Week Staff Published