Be a better investor: knowing when to sell

Timing is crucial to successful investment – and while it can be useful to follow your heart, don’t let it rule your head

As an investor, at some point in your investment career, you’ll be faced with one tricky dilemma. When, exactly, do you cut your losses? The fact is that selling a stock is much more difficult than buying one – especially a loser. Whether it’s pride or hope, there are plenty of psychological obstacles in your path. So to avoid being undone by your own emotions in the heat of the moment, you need to have a dedicated action plan in place, preferably from the minute you first invest in a company.

So how do you go about it? Firstly, you need to take control of your portfolio. What do I mean by that? Well, like most investors, you probably use online valuation tools to monitor your portfolio. That’s all well and good. But these valuation statements don’t have anything like all the information you need to monitor your investment – not least the reasons you bought the stock in the first place, and any thoughts you had on when you might sell.

That’s why you should have a notebook of some sort. I used to do this in an accounts ledger; these days it’s all on a spreadsheet. But it doesn’t matter what you use – the point is to have one place where you record not only the stock you bought, and the price you bought it at, but also your reasons for buying and what gave you the idea in the first place.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

At a bare minimum, I’d include the date, the company name, the source of the tip, the price you bought it at, the reason you bought it – in other words, what you expect to happen – and a rough idea of what sort of price you might consider selling at.

What’s the point of doing this? It’s because if you don’t write it down now, when you first invest, there’s much more chance that you’ll make a bad decision further down the line. You see, without this reference data, there’s no way of judging success – or failure. As soon as the share price has a bad day, you might be scared into selling, unless you can look back at your notebook and realise that your rationale for buying hasn’t changed. Equally, it’s all too easy to hang on to a loser after things have turned bad, but you have stubbornly persuaded yourself that you expected this all along. Looking back on your initial thoughts will make that sort of self-deception a lot harder to pull off.

In the notes I write, I also include a column assessing the management. Are they building trust, or destroying it? If they’ve made mistakes, how many more am I willing to take? The City adage is that profit warnings usually come in threes – are you willing to wait that long? And on some stocks, I’ll put together a timeline of how long I’m willing to wait for it to meet my targets – such as winning new contracts, or cutting costs – before I sell and find opportunities elsewhere.

The other thing to be aware of is your reaction to news about your stocks. When news releases come out – and as an investor, it’s easy enough to sign up to get all the latest releases on any given stock straight to your inbox – it’s important not to indulge knee-jerk reactions. Take a break from what you’re doing, and take a long hard look at the actual company news release – not some newspaper interpretation, which are flawed more often than you’d think.

Private investors have a great benefit at this stage. Yes, many people in the City react mmediately to these releases, but for most investors, it takes time for the information to sink in. Analysts will reflect on the news and write a note. Fund managers will learn about it all in tomorrow’s Financial Times. Many won’t have a clue until the situation is discussed in the next investment strategy meeting.

As a private investor, on the other hand, you shouldn’t have more than one or two dozen stocks to look after; or at least, if you keep on top of selling the losers, you shouldn’t have. That means your reactions should be lightning quick.

This may all sound like hard work. But, in reality, the ideas I’ve suggested here are the only things we, as private investors, have got to go on when judging the merits of our investments. Without documenting our thoughts, hopes and dreams, how can we know when it’s time to close the position down? And that’s vital – because, as with gardening, pruning is the key to a fruitful investment portfolio. And if you leave the pruning too long, it’s going to get messy. So set up a system and stick to it – then you won’t go far wrong.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

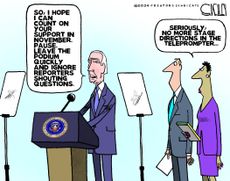

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

What to know amid the rise of separately managed accounts

What to know amid the rise of separately managed accountsThe Explainer SMAs can provide tax advantages, but investment minimums may be steep

By Becca Stanek, The Week US Published

-

What are the Magnificent Seven stocks and why do they matter?

What are the Magnificent Seven stocks and why do they matter?The Explainer It might seem like a no-brainer to dump your money into these Magnificent Seven stocks — but not so fast

By Becca Stanek, The Week US Published

-

Should you put your money in a CD?

Should you put your money in a CD?The Explainer Now may be the time to strike for the most competitive CD rates, but that doesn't necessarily mean CD investing is the right financial move for you

By Becca Stanek, The Week US Published

-

How fees impact your investment portfolio — and how to save on them

How fees impact your investment portfolio — and how to save on themThe Explainer Even seemingly small fees can take a big bite out of returns

By Becca Stanek Published

-

Early retirement: what is the ‘FIRE’ movement?

Early retirement: what is the ‘FIRE’ movement?feature Younger workers are aiming to quit the workforce early through extreme saving and investment

By Rebekah Evans Published

-

Why knowledge is the key to successful investing

Why knowledge is the key to successful investingfeature The best investment anyone can make is education. That’s especially true for investors

By The Week Staff Published

-

What the Ukraine crisis might mean for ESG investing

What the Ukraine crisis might mean for ESG investingfeature The Ukraine crisis has brought many of the issues around ESG investing into sharper focus. Where does the sector go from here?

By The Week Staff Published

-

Solar panels: are they worth the investment?

Solar panels: are they worth the investment?feature As electric bills go through the roof demand grows for alternative energy options

By The Week Staff Published