O2 gives up on London listing this year

Telecoms firm Telefonica joins software giant Misys in abandoning plans over Brexit-related market uncertainty

Spanish telecoms giant Telefonica has formally abandoned plans to list its UK mobile network O2 this year as a result of Brexit-related market uncertainty.

The news confirms a July report from Bloomberg saying the company had kicked the plans into the long grass after the market crash that followed the EU referendum result in June.

While the FTSE 100 has since recovered – and has spent many sessions above 7,000 and close to its record high – volatility remains high and that is playing havoc with new listings.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Alongside Telefonica postponing an offering it hopes will eventually raise around £10bn, software giant Misys has ditched its own plans for a listing that would have valued it at as much as £5bn, says City AM.

The Financial Times says Misys had already dropped its valuation for the transaction by around £1bn. Waste management company Biffa was forced to slash its own listing price by around a third earlier this month.

Planned flotations by auto parts-maker TI Fluid Systems, doughnut brand Krispy Kreme UK and Pure Gym Group have also been cancelled.

Telefonica has said it will seek to take the UK business public in 2017 "if market conditions are right".

The firm agreed to sell O2 to Three owner Hutchison in a deal worth £10.5bn last year, only for the European Commission to block it over competition concerns in May.

Telefonica decided to opt for a listing instead of a rival trade sale as the price would be considerably lower than Hutchison was prepared to pay. Proceeds will help it pay down a debt pile estimated at around €50bn (£454bn).

Earlier this week, Mark Evans, the chief executive of Telefonica's UK operations, told The Guardian: "We are not committing to a timeline [for a listing]. We just need to be ready if the market conditions are right... Be ready, be prepared."

Telefonica pulls plug on O2 sale amid Brexit turmoil

01 July

Telefonica has finally admitted defeat over its plan to sell or float its UK mobile network, O2, amid the market volatility unleashed by the Brexit vote last week.

In the spring of last year, the Spanish telecoms giant struck a £10.25bn deal to sell the business to UK mobile provider Three, which is owned by the Hong Kong-headquartered CK Hutchison. The merger was blocked in early May on competition grounds.

Since then, Telefonica had been considering selling O2 to a number of parties backed by private equity money – at a reduced asking price of £8.5bn – or offloading a minority interest through a listing.

But after the referendum result, company executives decided to kick the plan into the long grass following a meeting with financial advisers, according to Bloomberg.

The decision means the company will have to find another way to reduce its €50bn (£42bn) debt pile, which could prompt a credit downgrade in these times of heightened volatility.

ratings agency Moody's believes Telefonica may seek to cut a £3bn dividend planned for this year that "hinged" on the outcome of the UK vote. The Spanish firm could also look to issue "hybrid bonds" that qualify as equity and so would not add to the debt total.

Markets have been extremely volatile since the Brexit victory was announced, although they have risen to a ten-month high in the past day. There are also fears of an economic slowdown that could affect the price a buyer was willing to pay for O2.

Since the original Three deal was struck, Telefonica has been reporting O2 UK as a "discontinued operation" within the group. In a regulatory filing, it said it would now re-include the business's financial statements into wider results.

The company says it "continues to explore different strategic alternatives for O2 UK, to be implemented when market conditions are deemed appropriate".

Why Sky could be the 'kingmaker' for O2 buyout

23 May

Sky has "emerged as the potential kingmaker" as "a who's who of big private equity firms" join the bidding war for mobile network O2, the Daily Telegraph claims.

Since having its sale to UK mobile provider Three blocked by the European Commission earlier this month, O2 has been circled by rival buyers ranging from strategic investors to Virgin Media owner Liberty Global.

Estimated costs savings boosted the price Hutchison, Three's parent company, was willing to pay to above £10bn. Now prospective suitors are thought to be looking to strike a deal at a substantially lower £8.5bn.

However, for a private equity buyer, this would still represent the second largest European deal in the sector's history.

But the debt problems that prompted O2 owner Telefonica to seek a sale in the first place have eased, leading to speculation that such a price tag would not be high enough. Instead, the Spanish company has been eyeing the prospects for a stock market listing in which it would retain a stake, repeating the model it used when it offloaded O2 Germany in 2014.

Which is where Sky steps in. It has already said it will launch into the UK mobile market this year, planning to do so by acquiring capacity on the merged Three-O2 network after agreeing a ten-year deal if the tie-up had been given the green light.

The Telegraph says the company could resurrect that agreement and commit as much as £2bn to a "strategic partnership" that would give a huge liquidity boost to O2 and any potential buyer – and secure Sky better wholesale terms to launch its own "virtual" network, piggybacking on O2's infrastructure.

In the hopes of securing backing for their bid, Sky is being courted by at least five buyout consortiums, including the likes of "KKR, TPG, Bain Capital, Apollo, CVC Capital Partners and Apax Partners". As previously reported, O2 chief executive Ronan Dunne could yet front one of these bids.

All parties have declined to comment, but the Telegraph reckons such a set-up would "provide greater certainty over O2's earning power and allow private equity firms to bid more… making a buyout a more credible alternative to a stock market float".

O2 chief executive mulling £8.5bn management buyout

16 May

The latest buyout interest for the mobile network O2 is reported to come from the company's own chief executive, who is considering making a "debt-fuelled £8.5bn management buyout attempt".

Ronan Dunne has run O2 for eight years and, according to the Irish Independent, has said he would leave the company if the European Commission approved its £10.25bn merger with Three last week. In the event, the deal was blocked on competition concerns, meaning "he could be at the company a lot longer".

The Daily Telegraph reports that Dunne has been approached by a number of "private equity sponsors aiming to carry out what would be the largest UK leveraged buyout since before the financial crisis".

Such a deal would include a high level of debt, borrowed against the company's future earning potential, which would effectively ramp up the returns for financial backers. O2 is "seen as a good candidate for the manoeuvre… because of its strong and growing cash generation," the paper adds.

This is not the first rumour of private equity interest in the business since the Three deal was barred. Reports last week indicated that investor groups Apax and CVC Capital Partners would be willing to back a buyout bid led by Tom Alexander, a familiar face in the UK telecoms sector who was the chief executive of Orange UK and oversaw its merger with T-Mobile to form EE.

The Telegraph says the two men are known to be close and that Dunne is thought to be open to collaborating on a deal, but that there have as yet been no talks to that effect.

Other potential acquirers include Virgin Media owner Liberty Global and France's Iliad. Sky was thought likely to be interested in making a bid, but it is now believed to have ruled out the option. The company does want to launch into the mobile sector, however, and could independently invest in O2 to "help it acquire more radio spectrum rights or upgrade its coverage".

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

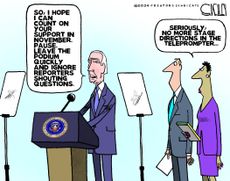

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

Three owner makes final pitch to win approval for O2 merger

Three owner makes final pitch to win approval for O2 mergerIn Depth Sky and Virgin could take big chunks of network capacity, while enlarged firm would invest in infrastructure

By The Week Staff Published

-

Phones 4u collapse: jobs saved after EE agrees to buy shops

Phones 4u collapse: jobs saved after EE agrees to buy shopsIn Depth EE, blamed by Phones 4u for precipitating its downfall, to save the day – with Vodafone

By The Week Staff Last updated