Budget 2016: How will the new Lifetime Isa work?

Government will top up savings for purchase of a first home or to provide a retirement income

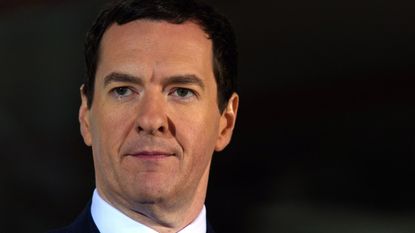

One of the key Budget changes that George Osborne said would the "next generation", from 2017 the newest addition to the burgeoning Isa franchise will be open for business.

What is it?

It's called the Lifetime Isa and is designed to act as either a flexible alternative pension-saving fund or to extend the mechanism of the existing Help to Buy Isa helping first-time buyers get on to the property ladder.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How will it work?

Much like Help to Buy, the government will give a bonus to savers who put money away and then don't touch it. However, in this case, the amounts available are higher and available over longer terms. If you save £4,000 a year, you're eligible for a top-up of 25 per cent – an extra £1,000.

The Isa is open to the under-40s and the bonuses are accrued until they turn 50. Savers can claim bonuses at any point before or after then to use towards a first house purchase and then claim either the lot or what is left over to help provide an income or lump sum in retirement when they hit the 60.

So will my money be locked away?

No. As with any other Isa, you'll be able to take the money out for emergencies if you need to, but it will work like other restricted access accounts so you will probably have to pay a fee and you'll lose the government bonus. A consultation will look at the option of following the 401k pension model in the US and allowing people to keep the bonus if they later replace any money they've withdrawn.

How does this affect my other Isas?

In terms of allowances each year, any money put in will count towards your overall limit and so reduce the amount you can place into other Isa accounts. However, the allowances are being increased so you'll have a total allocation of £20,000 to play with by the time this new account is introduced.

One specific crossover is with the Help to Buy Isa, which offers more limited bonuses purely to help people buy a house. Savers can either continue to use this scheme or transfer any money held across to a Lifetime Isa to benefit from the higher bonuses. You can only use one or other of the accounts to go towards a house deposit.

What about couples?

Yep, in the same way as the Help to Buy Isa, a couple can have one account each and both receive the bonuses.

How does it compare to standard pensions?

It's a completely different way of saving for a pension. You're putting money that has already been taxed into the fund and you don't get any of that tax back, but your savings will then grow tax-free and can be withdrawn tax-free in retirement.

Pensions are paid out of gross income before tax is deducted or, if tax has been paid, it is rebated. The income is then taxed in retirement, with the exception of a 25 per cent lump sum that you can take tax-free. Unlike the Isas, once your money is in your pension, you can't touch it before the age of 55 unless you want to incur a massive penalty tax charge.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'A direct, protracted war with Israel is not something Iran is equipped to fight'

'A direct, protracted war with Israel is not something Iran is equipped to fight'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Today's political cartoons - April 17, 2024

Today's political cartoons - April 17, 2024Cartoons Wednesday's cartoons - political anxiety, jury sorting hat, and more

By The Week US Published

-

Arid Gulf states hit with year's worth of rain

Arid Gulf states hit with year's worth of rainSpeed Read The historic flooding in Dubai is tied to climate change

By Peter Weber, The Week US Published