Climate change could cost the world £1.8tn if left unchecked

Long-term investors 'would be better off in a low-carbon world', says LSE professor

Climate change could cost the world trillions of pounds, according to a new study by the London School of Economics.

"Our work suggests to long-term investors that we would be better off in a low-carbon world," Professor Simon Dietz, the lead author of the report into the financial implications of climate change, told The Guardian.

Using a variety of models and based on pre-existing estimates of global GDP growth under various climate conditions and assumed weather-related consequences, the economists sought to estimate the "value at risk" around the world as a result of climate change.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"The study did not try to identify which sectors were most at risk," reports Reuters. Rather, it sought to estimate the potential value that could be wiped out due to the damage that climate change can wreak, "from the destruction of buildings, bridges or roads by storms or floods, to losses of agricultural productivity and enforced movement of populations".

In its core scenario, the paper states that if climate change is left unchecked and temperatures rise by 2.5C by the end of the century, then $2.5tn (£1.8tn) of value could be lost. If the world instead adheres to the terms of the deal struck in Paris at the end of last year to keep temperature rises below two degrees, this hit would be reduced by $800bn (£565bn).

At the most extreme end of the risk spectrum is a one per cent chance that losses would be as much as $24tn (£17tn) if climate change is not tackled, falling to $13tn (£12tn) under the two degree model.

The findings show that investors should be pushing for more action to limit carbon emissions and that long-term investors like pension funds in particular should be "getting on top of this issue", said Dietz.

He added that under any scenario, climate change will wipe value from global assets. The $5tn (£3.5tn) aggregate value of fossil fuel companies is under threat in particular, as the terms of the Paris deal imply much of the current reserves of oil and gas are left untouched.

"There is no scenario in which the risk to financial assets are unaffected by climate change. That is just a fiction," warned Dietz. "There will be winners and losers."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

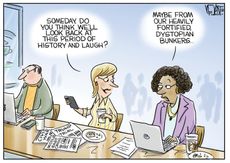

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

By The Week Staff Published

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

By The Week Staff Published

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

By The Week Staff Published

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’

By The Week Staff Published