Top hedge fund managers earning 'more than some nations'

Top bosses collectively took home £9bn last year, despite some of their funds losing investors' money

The highest-paid executives in the hedge fund industry were last year paid collectively more than the value of "the entire economies of Namibia, the Bahamas or Nicaragua", reports The Guardian.

According to the annual estimates published by Institutional Investors Alpha, the top 25 executives earned just shy of $13bn (£9bn). The top two, Citadel founder and chief executive Kenneth Griffin and James Simons, the founder and chairman of Renaissance Technologies, each took home $1.7bn (£1.17bn), "equivalent to… 112,000 people taking home the US federal minimum wage of $15,080".

"Even as regulators push to rein in compensation at Wall Street banks, top hedge fund managers earn more than 50 times what the top executives at banks are paid," notes the New York Times.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Beyond simply enraging a wider population earning a tiny fraction of these amounts, the data points to some interesting trends that may worry hedge fund investors. Namely, there are a number of managers making ever larger pots of money, even when performance is poor and investors' money is being lost.

As an example, Ray Dalio made $1.4bn (£970m) in 2015 through Bridgewater Associates, the world’s biggest hedge fund firm with $150bn (£103bn) of assets under management and whose risk parity fund, called All Weather, lost seven per cent.

In all, five men – and they are all men – made bumper profits despite their funds performing poorly in a market the billionaire manager Daniel Loeb has called a "hedge fund killing field".

This is because hedges funds tend to operate a "two and 20" remuneration model, where the firm takes a two per cent fee out of the assets of the fund and 20 per cent of any profits above a certain "hurdle" rate. Some firms are now making more money from the two per cent element by amassing a huge asset base than they could ever make from outperformance.

Todd Petzel, the chief investment officer at private wealth management firm Offit Capital, said this poses a due diligence challenge for institutional investors in what is meant to be a risky alternative asset class.

"Once a hedge fund gets to be large enough to produce incredibly outsized remuneration, the hardest part of due diligence is determining whether the investment process is affected," he explained. "Is the goal to continue to make money in a risky environment or is the goal to preserve assets on which you collect fees?"

Infographic by www.statista.com for TheWeek.co.uk

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 14, 2024

Today's political cartoons - April 14, 2024Cartoons Sunday's cartoons - Trump Derangement Syndrome, social media dangers, and more

By The Week US Published

-

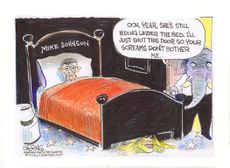

5 rambunctious cartoons about the House speakership standoff

5 rambunctious cartoons about the House speakership standoffCartoons Artists take on Mike Johnson's night terrors, the Speaker's chair, and more

By The Week US Published

-

The Week Unwrapped: Ultrarunning, menswear and a meaty row

The Week Unwrapped: Ultrarunning, menswear and a meaty rowPodcast Is the "Hardest Geezer" a high-endurance trendsetter? Will Ted Baker survive? And what's the beef with lab-grown meat?

By The Week Staff Published

-

Home Office worker accused of spiking mistress’s drink with abortion drug

Home Office worker accused of spiking mistress’s drink with abortion drugSpeed Read Darren Burke had failed to convince his girlfriend to terminate pregnancy

By The Week Staff Published

-

In hock to Moscow: exploring Germany’s woeful energy policy

In hock to Moscow: exploring Germany’s woeful energy policySpeed Read Don’t expect Berlin to wean itself off Russian gas any time soon

By The Week Staff Published

-

Were Covid restrictions dropped too soon?

Were Covid restrictions dropped too soon?Speed Read ‘Living with Covid’ is already proving problematic – just look at the travel chaos this week

By The Week Staff Last updated

-

Inclusive Britain: a new strategy for tackling racism in the UK

Inclusive Britain: a new strategy for tackling racism in the UKSpeed Read Government has revealed action plan setting out 74 steps that ministers will take

By The Week Staff Published

-

Sandy Hook families vs. Remington: a small victory over the gunmakers

Sandy Hook families vs. Remington: a small victory over the gunmakersSpeed Read Last week the families settled a lawsuit for $73m against the manufacturer

By The Week Staff Published

-

Farmers vs. walkers: the battle over ‘Britain’s green and pleasant land’

Farmers vs. walkers: the battle over ‘Britain’s green and pleasant land’Speed Read Updated Countryside Code tells farmers: ‘be nice, say hello, share the space’

By The Week Staff Published

-

Motherhood: why are we putting it off?

Motherhood: why are we putting it off?Speed Read Stats show around 50% of women in England and Wales now don’t have children by 30

By The Week Staff Published

-

Tonga’s tsunami: the aid effort turns political

Tonga’s tsunami: the aid effort turns politicalSpeed Read Efforts to help Tonga’s 105,000 residents have been beset by problems

By The Week Staff Published