Shell sets up renewable energy unit to avoid 'brutish and short end'

Company reckons new operation could become "very big – but not for a decade"

Europe's largest oil company, Shell, is set to announce a major expansion of its renewable energy activity and a "new drive into wind power", as it seeks to avoid the "nasty, brutish and short end" that experts predict will be the fate of existing oil major business models over the coming decade.

The move comes only a few months after the UN summit in Paris last December when members made their strongest commitment yet to reduce carbon emissions. The deal will see a renewed push towards green energy by governments as well as calls for more fossil fuels to be left "in the ground".

Shell's decision to invest in renewable energy follows a crash in the oil price over the past two years, with no return to the three-figure highs of 2014 predicted for some time.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This has led to the Chatham House think-tank stating in a research paper earlier this month that the oil majors are "no longer fit for purpose". The Guardian says the group argues that the only way forward for these behemoths is "diversifying into green energy, drastically reducing their operations or consolidating through mega-mergers".

This month, another research firm, Carbon Tracker Initiative, called on oil majors to "slim down and base their business models around global warming targets".

Shell's new business operation, New Energies, will "bring together existing hydrogen, biofuels and electrical activities but will also be used as a base for a new drive into wind power", according to an internal announcement to company staff reported by The Guardian.

The unit will have $1.7bn of capital investment and annual capital expenditure of $200m. Shell is thought to believe that its new division could become very big – "but not for a decade". The oil giant is seeking to place itself at the forefront of the move into green energies without getting "so far in front [that it] dilutes investor returns".

"It is unlikely Greenpeace and others will be impressed by New Energies, given that the division's annual spending level is less than 1% of the total $30bn Shell pumps into oil and gas," notes the paper.

Shell is also reported to be seeking to spin out a unit housing "non-core" exploration assets, dubbed "Baby Shell", as it seeks to reduce a debt pile that has risen to $70bn with the acquisition of BG Group. The company could seek to list the new entity, the Daily Telegraph says, so that it reduces the size of its balance sheet while retaining exposure in order to benefit from any "sustained oil price recovery".

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

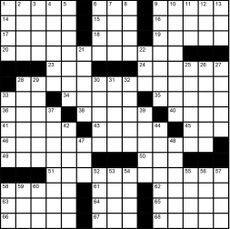

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

US-led price cap on Russian oil 'almost completely circumvented'

US-led price cap on Russian oil 'almost completely circumvented'Speed Read 'Almost none' of seaborne crude oil from Moscow stayed below $60 per barrel limit imposed by G7 and EU last year

By Harriet Marsden, The Week UK Published

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

By Elliott Goat, The Week UK Published

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

By Justin Klawans, The Week US Published

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

By The Week Staff Published

-

Opec+: what oil production cut means for the West

Opec+: what oil production cut means for the Westfeature Dramatic drop in output helps Russia but could spell further price rises for consumers

By Fred Kelly Published

-

US angered by Opec+ oil cut

US angered by Opec+ oil cutSpeed Read Energy prices to rise further as producers slash supply by two million barrels a day

By Fred Kelly Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

The countries that could follow Sri Lanka into economic chaos

The countries that could follow Sri Lanka into economic chaosWhy Everyone’s Talking About Food and fuel shortages that rocked Asian nation are spreading around the globe

By The Week Staff Published