Why you're facing a £30,000 pension black hole

Period of slower returns would knock a big hole in future income potential

A slowing global economy could mean people in their 30s and above are facing a huge shortfall in their pension savings.

Consultancy firm McKinsey & Company predicts that the global economy is going to slow down, leading to falling investment returns that in turn means our pension savings won't grow at the rate we have become accustomed to.

Its research found that over the past 20 years, the average pension pot has managed an annual return of 6.7 per cent after charges. As a result, someone saving £200 a month would have built up pension savings worth around £98,000 today.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But McKinsey doesn't believe that level of growth will be achievable over the next two decades and predicts average returns of just 3.4 per cent a year will become the norm. That could have catastrophic results, with £200 a month building up a pot worth just £68,700.

The difference between the savings achieved over the two time periods is a massive £30,000, which would make an enormous difference to the pension income a person could achieve.

"The implications are serious and these numbers should serve as a wake-up call to savers, who need to realise it may not be as easy to make returns in the future," Darius McDermott, the director of broker Chelsea Financial Services, told Money Mail.

The reason for the shortfall is that McKinsey believes the global economy is decelerating. Over the past 20 years, stock markets across the world have done well thanks to falling inflation and lower interest rates helping big firms boost their profits. However, that could be about to change.

"The big North American and Western European firms that took the largest share of the global profit pool in the past 30 years face new competitive pressures as emerging market companies expand, technology giants disrupt business models and smaller rivals compete for customers," says McKinsey's report.

In order to counteract this slowing growth, savers need to invest an extra £1,000 a year into their pensions.

If you can afford to do that and it doesn’t take you over any of the pension contribution limits, it is certainly worth considering. The tax breaks on pension contributions are generous and should be grabbed if you can afford to do so.

However, not everyone can afford to lock away an extra £1,000 a year. The good news is there are alternative ways to boost your pension returns. Firstly, if you haven't joined your workplace pension scheme, do so.

"It makes sense for most people to join their company pension scheme," says Patrick Connolly, a certified financial planner at Chase de Vere. "These schemes are usually good value and all employers have to pay into their eligible employees' pension." That means your pension pot will get a boost as your employer will be contributing, too.

Secondly, take a look at how your funds are performing and how much you are paying in fees and charges. Don't get stuck with underperforming funds or paying expensive fees for a fund manager who isn't earning his keep.

Consider investing in tracker funds - they won't ever outperform the market like a fund manager might, but they are a lot cheaper so you'll be giving away less of your returns.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 14, 2024

Today's political cartoons - April 14, 2024Cartoons Sunday's cartoons - Trump Derangement Syndrome, social media dangers, and more

By The Week US Published

-

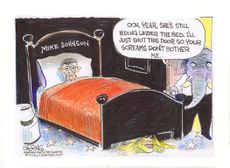

5 rambunctious cartoons about the House speakership standoff

5 rambunctious cartoons about the House speakership standoffCartoons Artists take on Mike Johnson's night terrors, the Speaker's chair, and more

By The Week US Published

-

The Week Unwrapped: Ultrarunning, menswear and a meaty row

The Week Unwrapped: Ultrarunning, menswear and a meaty rowPodcast Is the "Hardest Geezer" a high-endurance trendsetter? Will Ted Baker survive? And what's the beef with lab-grown meat?

By The Week Staff Published