How to cut your Christmas costs with cashback

Credit cards, debit cards and specialist websites allow you to earn while you spend

Last year the average family spent £800 on Christmas, according to National Debtline. If they had made the most of cashback offers they could have earned a big chunk of that back: here's how to claw back some of your festive spending this year.

Cashback credit cards

Paying for Christmas with a credit card is a great idea, even if you don't need to spread the cost. Purchases on credit cards benefit from the extra protection of Section 75 of the Consumer Credit Act. This means if there is a problem with your purchase, or the shop goes bust before you receive your item, you may be able to claim your money back from your credit card provider if the retailer doesn't pay up.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Additionally, choose the right credit card and you can earn money while you shop. There are a number of cashback credit cards on the market. The best right now the American Express Platinum Cashback card, which pays five per cent cashback for the first three months up to a maximum of £125. After that you earn 1.25 per cent cashback. The drawback is there is a £25 annual fee, but if you spend enough you'll easily cancel that out with your cashback earnings.

The next best is TSB’s Advance Credit Card which pays one per cent until 30 September 2017 if you have a TSB Classic Plus Account. Alternatively, if you are going to do your Christmas food shop at Asda take a look at its Cashback Plus card, which pays two per cent on Asda spending and one per cent elsewhere. It does have a £3 monthly fee, though.

Cashback debit cards

Cashback tends to be the preserve of credit cards but there are one or two current accounts that come with cashback perks. TSB's Classic Plus account pays five per cent cashback on your first £100 of contactless payments each month, plus you’ll get £100 if you switch to the account before the end of the year.

Nationwide and Halifax also offer cashback on debit card spending, but you have to select offers via your online banking before you set off shopping. It is worth doing though as some offer as much as 15 per cent cashback.

Cashback websites

Once you have a cashback credit or debit card you can double your cashback by also shopping via a cashback website such as Quidco or Topcashback. Register for free then tap in the name of the store you are planning on shopping at, you’ll then be shown any cashback offers that are currently available.

Click on the link provided and you’ll be taken to that store’s website where you can shop as normal. You’ll then receive your earnings back into your cashback website account.

At present Quidco has up to six per cent cashback at Debenhams, ten per cent at FeelUnique.com and 12 per cent at Very. While Topcashback has 7.35 per cent at Body Shop, 12.6 per cent at Boohoo.com and 7.35 per cent on beauty gifts from Boots. Both have hundreds of other offers so it is well worth signing up to earn money while you shop.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

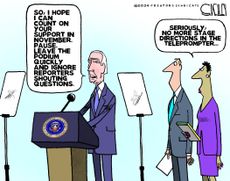

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published