Why you shouldn't leave buying foreign currency to the last minute

The pound is likely to remain volatile for a while - and buying in advance can get you a much better deal

The markets hate uncertainty and this month’s election result has made the UK political situation more, not less, stable. As a result the pound took a tumble from around $1.30 against the dollar to below $1.27 - and it remains around $1.275 now.

For those preparing for their holidays abroad, this has left them facing a more expensive trip to the foreign exchange.

Over the next two years there is bound to be a lot of uncertainty as the UK heads towards Brexit and this means the pound is likely to have a bumpy ride. So, how can you avoid a painful financial sting if the pound is down and you need to buy your holiday money?

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Try following these top tips.

Buy your money little and often

No-one can time the market - and the market has been defying the predictions of even the most noted experts of late.

That means you cannot predict when the pound is going to be having a good day and sweep in and buy your foreign currency at a bargain price. However, you can avoid the big hit of having to buy all your currency when the pound is weak by slowly stockpiling your foreign currency.

Get a pre-paid currency card, such as those offered by Resolute or Monzo, and slowly put money onto it over a number of weeks or months. This not only allows you to spread the cost of your holiday money but it also means you will buy currency on some days when it is cheaper than others, smoothing out the fluctuations in the value of the pound.

Lock in a rate

Some foreign currency providers, including Moneycorp and Travelex, allow you to preorder your foreign currency at no additional charge for pick up in 14 days time.

If you plan ahead and order 14 days before your holiday you are locking in the foreign exchange rate on the date of your order. This could work out well if the value of the pound falls over the two weeks. But, you also don’t have to miss out if the value of the pound rises: you can always cancel your order and make a new one.

Get the best rate

If you have to buy your currency when the pound is weak then it is really important that you get the best possible exchange rate. Buy your currency at the airport and you’ll pay 26 per cent more than if you had planned ahead, according to research by FairFX.

The easiest way to get the best possible rate is to visit TravelMoneyMax.com. Type in how much of what currency you want to buy and it’ll compare credit cards, debit cards and foreign exchange bureaux to tell you the best value way to get that money.

When I checked it showed a difference of almost €50 between the best and worst rates for exchanging £1,000 into euros. The best rate would also buy you €250 more than if you waited to exchange your money at the airport.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

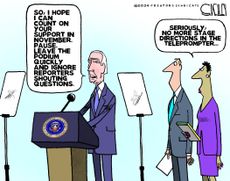

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published