Five things to consider when remortgaging

Make sure you shop around and be watchful of hefty hidden fees

Interest rates are low and there are some great mortgage deals available. As a result, the number of us remortgaging is booming - figures from the Council of Mortgage Lenders show such loans made up a third of all lending in April.

However, if you are thinking of remortgaging, make sure you consider the following five things.

1. The value of your home

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

House prices are still rising in most of the country so get an accurate value for your home. The easiest way to do this is to invite two or three estate agents round to value it.

The more your property is worth, the lower your loan-to-value (LTV) will be on your remortgage – how much you are borrowing as a percentage of the value of your home – and the lower your LTV, the lower the interest rate you'll pay.

2. Loyalty doesn't pay

Staying with your current mortgage provider, or looking to get a mortgage from your current account provider, will probably leave you paying more than you need to.

An investigation by Money Mail found that six out of ten of the UK's largest lenders charge their own customers higher rates than those switching from another lender. The difference in interest rate could add up to loyal old-timers paying £300 a year more than new customers.

So, when it is time to remortgage, shop around and switch to a new lender to get the best possible rate.

3. The fees

Don't get too hung up on the interest rate when you are comparing different mortgage deals. It is important, but so are the fees. Many lenders will launch mortgage deals with very low rates to get themselves to the top of the best-buy tables, but they'll protect themselves from losing money by including hefty fees.

For example, Yorkshire Building is top of the tables with a 0.99 per cent fixed-rate mortgage, but it has a £1,495 fee. In contrast, Skipton Building Society’s two-year fixed rate is 1.48 per cent, but with no fee, leaving you £1,088 better off in the first year than if you opted for the lower rate, assuming a £150,000 mortgage over 25 years on a repayment basis.

The effect of the fee will depend on how large your mortgage is: if you have a very large loan, it may be worth paying the bigger fee in order to get the lower interest rate. You can compare mortgage rates and fees using Money Saving Expert's mortgage calculators.

4. Small savings add up

Your lender has offered you a remortgage rate of 1.5 per cent, but the best buy rate is 1.2 per cent - is it worth the hassle of switching? Well, over two years, you would save yourself almost £700, even allowing for fees. A small difference in interest rates can mean big savings over the years.

Over a 25-year mortgage, that kind of small difference can add up to thousands of pounds saved.

5. Independent advice

Finding the best mortgage deal for your individual circumstances is difficult. Do you want a low interest rate or a low fee? Will a lender accept your application for that best-buy rate or are you better off applying for a different deal you are more likely to be accepted for?

Given that your mortgage is likely to be the biggest financial commitment you ever make, it is one area where seeking out independent advice could reap you huge rewards. Consider using a mortgage broker to help you navigate the mortgage market and make sure you get the best possible deal for you. They typically cost around £200-£500 but are likely to save you a lot more than that over the life of your deal.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The hunt for Planet Nine

The hunt for Planet NineUnder The Radar Researchers seeking the elusive Earth-like planet beyond Neptune are narrowing down their search

By Chas Newkey-Burden, The Week UK Published

-

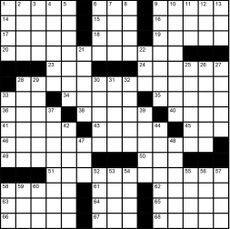

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published