Is household debt leading us to a new financial crisis?

Experts warn we could be heading into trouble again, but history may not repeat itself just yet

Debt problems seen in the run-up to the financial crisis are "rearing their heads" again," according to MP Rachel Reeves, the new head of the parliamentary business select committee, reports the BBC.

Her warning came a day after the Bank of England's director for financial stability warned of a "spiral of complacency" pushing household debt to "dangerous" levels, says The Guardian.

Reeves and the bank are the latest to say we should be concerned about the scale of personal debt, with the clear implication that we are seeing the same sort of reckless behaviour that led to the financial crash of 2007.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But are they right?

Risky business

The key concern for Alex Brazier, stability director at the Bank of England, is the rise in "unsecured credit" - borrowing that is not secured against a personal asset, usually the likes of credit cards, personal loans and car finance. Secured lending tends to relate to mortgages.

"Over the past year, Brazier said, household incomes had grown by just 1.5 per cent but outstanding car loans, credit card balances and personal loans had risen by ten per cent," says the Guardian.

Unsecured credit's fastest-growing area is car financing, says the Financial Times. The amount loaned through car dealerships increased 15 per cent over the past year, with financed purchases now accounting for four out of five car sales.

Credit cards have also been growing rapidly; the total amount owed on plastic in the UK surpassed the pre-crash peak to hit £67.3bn in February, says the FT.

Repayment terms have been eased, said Brazier. "The average advertised length of zero per cent credit card balance transfers [has] doubled to close to 30 months," he said. "Advertised interest rates on £10,000 personal loans [have] fallen from eight per cent to around 3.8 per cent, even though official interest rates had barely changed."

All in all, Brazier, said there are "classic signs" of lenders believing the risks are lower following a prolonged period of good economic performance and few defaults, but "the risks they – and the wider economy – face are actually growing".

Safer than before

The story for secured lending is very different, with issuance of home loans up a more modest three per cent in the past 12 months, said Brazier.

As mortgages account for £1.3trn of the £1.5trn in personal debt, this implies the risk being taken on by banks is lower than the unsecured figures alone might imply.

It was the huge volumes of mortgage lending that led to the last financial crisis, after a sizeable chunk of loans to "sub-prime" borrowers in the US defaulted.

Slower mortgage lending growth implies overall debt growth has been more moderate than the unsecured figures suggest.

At the end of June, the Bank of England published figures showing that "in recent years total borrowing from banks has grown roughly in line with incomes", says the FT.

According to the BBC, total debt as a share of aggregate household income is well below its peak of 160 per cent in 2008.

However, it is also above the post-crash trough of 140 per cent and the Office for Budget Responsibility predicts it will reach 153 per cent in 2022.

Overall, the FT says the Bank of England has until now judged that lending growth for the country as a whole has been running at an "unsustainably rapid pace", but "within that, there are some households whose debt is unsustainable".

Lessons from the past

This conclusion mirrors the debate over personal debt escalation to record levels in the US, which Bloomberg says has lagged income growth and population increases and so accompanied a fall in per capita borrowing.

It seems, then, that the risk of a global debt-fuelled meltdown such as we saw in 2008 is unlikely, while easier repayment terms will only enhance the likelihood of fewer problem debtors.

But there is enough in the unsecured lending numbers to make experts nervous and enough money owed by households that a significant increase in defaults could cause banks problems.

This would spell problems for the economy: those struggling to service debt are likely to cut back on spending, while lenders that see an increase in loan defaults will probably cut back on lending activity.

Here is where Brazier and his colleagues come in. As of last month, they ordered high street banks to hold back more capital in reserve against consumer borrowing in order to provide cover for defaults without disrupting existing lending, says The Guardian.

The bank is also bringing forward the next review to September and could enhance these protections.

At the same time, it has told lenders to conduct tougher affordability assessments, especially for mortgages.

This all comes at a time when lending growth could already be falling anyway, as banks become "increasingly cautious about the worsening economic outlook", says the FT.

All of this suggests that whatever is happening in the market, regulators and others are alive to the risks and are putting into practice some of the lessons from the 2008 crash to avoid a repeat.

At least, that is the idea.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

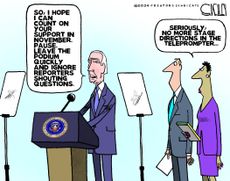

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published