Why does South Korea matter so much to Bitcoin?

Authorities announce plans to crackdown on cryptocurrency trading

South Korea has become the surprise battle ground for the future of Bitcoin, after authorities announced plans to crackdown on cryptocurrency trading.

Exactly how it will do this remains vague, “but just the threat of action has been enough to drive a sell-off across the market globally” and spark a wave of protests across the country, says the BBC.

Bitcoin briefly fell more than 17% to a six-week low after South Korea Finance Minister Kim Dong-yeon said that shutting down digital currency exchanges was still an option for the government.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

While its has recovered slightly, this has pushed Bitcoin below $10,000, half what it was worth at its peak.

The cryptocurrency market is notoriously volatile but events in South Korea appear to have a disproportionate effect on trading.

Digital currency website Coinhills says South Korea is the third-biggest market for Bitcoin trades in the world, behind Japan and the US, and with over a dozen cryptocurrency exchanges.

According to analytics firm WiseApp, the number of cryptocurrency app users in South Korea has increase 14-fold in the past three months to about two million users, around 5% of the total population

However, unlike other countries, it is not just the tech-savvy who have jumped on the Bitcoin band-wagon, but ordinary workers, housewives and even children, many of whom would never trade traditional stocks.

The high demand from South Koreans has created what investors call a “kimchi premium,” the extra price the South Koreans have to pay to buy digital currencies, sold in South Korea at higher than the average global prices.

This has prompted fears a burst in the Bitcoin bubble could have wide-ranging and potentially devastating effects and stirred the authorities into action.

While it is unclear what, if any, measures the government will take, traders are fearful that where they lead others will follow, ushering a wave of new legislation regulating the virtual currency market and making it easier for trading exchanges to be raided by tax authorities.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Today's political cartoons - April 13, 2024

Today's political cartoons - April 13, 2024Cartoons Saturday's cartoons - moderate MAGA, automotive politics, and more

By The Week US Published

-

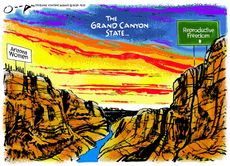

5 Grand Canyon-size cartoons on the Arizona abortion ruling

5 Grand Canyon-size cartoons on the Arizona abortion rulingCartoons Artists take on a chasm in reproductive freedom, the dangers of an abortion ban, and more

By The Week US Published

-

Crossword: April 13, 2024

Crossword: April 13, 2024The Week's daily crossword

By The Week Staff Published

-

US regulators approve Bitcoin ETFs – what it means for UK crypto fans

US regulators approve Bitcoin ETFs – what it means for UK crypto fansThe Explainer US crypto fans can now invest in Bitcoin exchange traded funds but UK investors are likely to remain blocked

By Marc Shoffman, The Week UK Published

-

Brits keeping 21 million ‘money secrets’ from friends and family, survey reveals

Brits keeping 21 million ‘money secrets’ from friends and family, survey revealsSpeed Read Four in ten people admit staying quiet or telling fibs about debts or savings

By Joe Evans Last updated

-

London renters swap cramped flats for space in suburbia

London renters swap cramped flats for space in suburbiaSpeed Read New figures show tenants are leaving Britain's cities and looking to upsize

By The Week Staff Published

-

Should the mortgage holiday scheme have been extended?

Should the mortgage holiday scheme have been extended?Speed Read Banks warn that some homeowners may struggle to repay additional debt

By The Week Staff Last updated

-

RBS offers coronavirus mortgage holidays

RBS offers coronavirus mortgage holidaysSpeed Read Taxpayer-owned bank follows measures taken in virus-struck Italy

By The Week Staff Last updated

-

What are the changes to National Savings payouts?

What are the changes to National Savings payouts?Speed Read National Savings & Investments cuts dividends and prizes for bonds

By The Week Staff Published

-

‘Colonial relic’: why eight African countries have severed currency ties with France

‘Colonial relic’: why eight African countries have severed currency ties with FranceSpeed Read Former French colonies to replace the CFA franc with the eco

By The Week Staff Published

-

China clears path to new digital currency

China clears path to new digital currencySpeed Read Unlike other cryptocurrencies, Beijing’s would increase central control of the financial system

By Elliott Goat Last updated