Brits in the dark about partner’s finances

10m people don’t know if their other half’s money is banked or invested

A quarter of British people are uncertain about their partner’s finances, with new research suggesting huge numbers of people would not know where to look for assets if their other half suddenly died.

According to Direct Line insurance, more than one in five married people have not given their partner their current account number, have denied their husband or wife’s access to their savings details, or have a partner who doesn’t know the details of their pension. About 16% of married people would not give their spouse access to their credit card details.

These figures rise even further when expanded to include unmarried couples. An estimated 10 million people are unsure of where their partner’s money is banked or invested.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Earlier this year, a separate study by GoCampare found that one in eight people said their partner doesn’t know how much they have in savings and 7% have actively kept it a secret.

Research has found that women are five times more likely than men to keep their savings a secret.

“Financial secrecy extends to modern technology too,” says The Independent, with another recent survey suggesting a third of Brits wouldn’t give their partner their phone access code.

While compromising messages or photos was one of the reasons given, the majority of those questioned said it was because their phone had banking details stored on it and they did not want their partner to access it.

Georgie Frost, consumer advocate at GoCompare, said “an important thing to take away from this research is how we’re starting to see a long-term shift towards people wanting to stay in financial control, particularly women.”

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

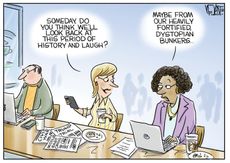

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published

-

Should you use a 529 plan? What to know about this college savings option.

Should you use a 529 plan? What to know about this college savings option.The Explainer This tax-advantaged savings account can be used to pay tuition or buy textbooks

By Becca Stanek, The Week US Published

-

Is a high-yield savings account worth having?

Is a high-yield savings account worth having?The Explainer They can pay up to 10 times more than a standard savings account

By Becca Stanek, The Week US Published

-

Why 401(k) early withdrawals are on the rise — and what to consider before you do it

Why 401(k) early withdrawals are on the rise — and what to consider before you do itThe Explainer It actually has some notable financial consequences

By Becca Stanek, The Week US Published

-

Is it ever worth taking a pay cut?

Is it ever worth taking a pay cut?The Explainer Though a lower income will mean reworking your budget, it can also mean more free time and a better work-life balance

By Becca Stanek, The Week US Published

-

What is loud budgeting, and is it worth a shot?

What is loud budgeting, and is it worth a shot?The Explainer The TikTok trend encourages users to go public with their monetary decisions

By Becca Stanek, The Week US Published

-

Got a raise? 5 ways to make the most of it.

Got a raise? 5 ways to make the most of it.The Explainer While a bump in pay might tempt you to loosen up your spending, it is better to think strategically

By Becca Stanek, The Week US Published

-

3 steps to reach financial stability this year

3 steps to reach financial stability this yearThe Explainer Work toward peace of mind by reducing stress related to money

By Becca Stanek, The Week US Published

-

State pension underpayments: are you getting the right amount?

State pension underpayments: are you getting the right amount?feature Hundreds of thousands of women may have received less than they were owed

By Rebekah Evans Published