ECB to end stimulus programme by year’s end

European central bank to ease back on quantitative easing measures but continue to keep rates

The European Central Bank will phase out its massive bond-buying programme, which has been propping up the eurozone economy since the credit crunch, by the end of the year.

Despite warning that the single currency area was going through a soft patch at a time when protectionist risks were rising, ECB President Mario Draghi said it will cut quantitative easing from €30bn per month now to €15bn a month in September. It will come to a full stop in December.

The move “is a major step towards dismantling the policies brought in to stabilise the eurozone in the wake of the financial crisis” says the BBC.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It brings to an end the ECB’s €2.4 trillion (£2.1 trillion) asset-purchase programme introduced in March 2015 to avert the threat of deflation in the eurozone.

The decision represents a belief in the central bank that the eurozone economy, after years of weakness and recession, “is now sufficiently robust that it can start to withdraw monetary stimulus” says The Independent.

Signalling that the move would not mean rapid policy tightening in the coming months, the bank also said that interest rates would stay at record lows at least through the summer of 2019, “suggesting protracted support for the economy, even if at a lower level”, says Reuters.

The Guardian says the ECB’s statement “reflected the battle between hawks and doves on the bank’s council, with the decision on QE matched by a softening of its approach to interest rates”.

It does, however, signal the beginning of the end for easy money from the world’s top central banks, with the US Federal Reserve dropping a major crisis-era stimulus pledge earlier this week.

BBC economics correspondent, Andrew Walker, described the move as “an important moment”.

“It reflects the fact that the Eurozone recovery appears well established - though it has cooled somewhat this year,” he said.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

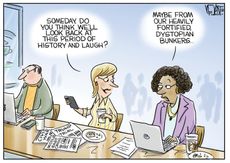

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published

-

Geopolitics and the economy in 2024

Geopolitics and the economy in 2024Talking Point The West is banking on a year of falling inflation. Don't rule out a shock

By The Week UK Published

-

First Republic: will UK banks survive unscathed?

First Republic: will UK banks survive unscathed?Under the Radar US shares dip after collapse of third regional bank, but experts say contagion to the UK is unlikely

By Arion McNicoll Published

-

Should the UK relax bank ring-fencing rules?

Should the UK relax bank ring-fencing rules?Talking Point Treasury minister said he hopes to ‘boost competitiveness’ in the City with easing of regulations

By Richard Windsor Published

-

Would Credit Suisse collapse mean a repeat of 2008?

Would Credit Suisse collapse mean a repeat of 2008?Talking Point CEO of troubled Swiss bank attempts to soothe nerves but default risk remains

By The Week Staff Published

-

Should caps on bankers’ bonuses be scrapped?

Should caps on bankers’ bonuses be scrapped?Talking Point New chancellor Kwasi Kwarteng believed to be planning contentious move to ‘boost the City’

By Chas Newkey-Burden Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated