Reddit vs. Wall Street: silver is new battleground

Small-time investors are targeting the precious metal following GameStop trading frenzy

The price of silver has hit a five-month high as the online trading war between Reddit users and Wall Street hedge funds spills over into the precious metals market.

Last week, shares in struggling US video-games retailer GameStop skyrocketed after Reddit forum WallStreetBets took on huge hedge funds that were betting against the stock. The war between short sellers and the band of private investors has seen GameStop’s share price jump by 1,700% in the space of a month.

Now, small-time investors on WallStreetBets are teaming up to pump their money in silver, in what appears to be a fresh bid “to hurt big banks they believe are artificially suppressing prices”, says CNN.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Buying en masse

Along with the hike in silver-mining stock prices, coin-selling websites were also “swamped” this morning as “small-time investors piled in to the metal”, The Guardian reports.

Silver prices quickly climbed as high as $30 an ounce, its highest value in eight years, as traders “bought en masse”, adds the BBC.

WallStreetBets forum members argue that silver is a heavily manipulated market, and “a surge in the silver price could hurt large Wall Street players”, the broadcaster adds.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Reddit user RocketBoomGo said: “Think about the Gainz. If you don’t care about the gains, think about the banks like JP MORGAN you’d be destroying along the way.”

All that glitters

The hashtag #silversqueeze was trending on Twitter as retail silver coin sites became “overwhelmed with physical demand for silver” early on Monday before grinding to a halt as the buying “frenzy” for bars and coins took hold, Bloomberg reports.

Bitcoin billionaires the Winklevoss twins - who famously sued Mark Zuckerberg for allegedly stealing the idea for Facebook - both tweeted their support for WallStreetBets.

Tyler Winklevoss said the “#silversqueeze is a rage against the machine”.

Meanwhile, Cameron Winklevoss wrote that the “ramifications of a #silversqueeze cannot be underestimated”, adding: “If Silver market is proven to be fraudulent, you better believe Gold market will be next. HUGE implications especially for countries that have de-dollarized and central banks with large Gold holdings.”

Create an account with the same email registered to your subscription to unlock access.

Mike Starling is the digital features editor at The Week, where he writes content and edits the Arts & Life and Sport website sections and the Food & Drink and Travel newsletters. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

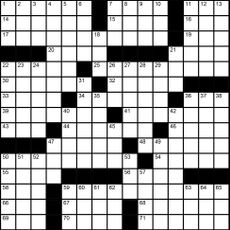

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published