Elon Musk and Tesla bet big on bitcoin

Cryptocurrency’s value hits record high after car firm reveals $1.5bn investment

Elon Musk has put his money where his mouth is after adding the hashtag “#bitcoin” to his Twitter profile just over a week ago.

The price of the cryptocurrency surged following his apparent endorsement on 29 January. And despite removing the hashtag from his profile a couple of days later, the tycoon has continued to “talk up” bitcoin to his 46.2 million followers, the BBC reports.

Now, Musk has announced that his electric car firm Tesla pumped $1.5bn (£1.1bn) into the cryptocurrency last month - sending the price of the digital currency soaring to an all-time high. On Tuesday morning, one bitcoin was worth more than $46,400 (£33,700), according to CoinMarketCap.com.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The latest price hike leaves bitcoin up by almost 50% this year, following gains of more than 300% in 2020.

A ‘game changer’ for bitcoin

In a regulatory filing to the US Securities and Exchange Commission (SEC), Tesla said the decision to invest in bitcoin was part of a broad investment policy aimed at “diversifying and maximising returns on our cash that is not required to maintain adequate operating liquidity”.

Tesla also revealed plans to accept bitcoin as a form of payment - a move that analysts say could prove to be a “game changer” for the cryptocurrency, Sky News reports.

Eric Turner, vice president of market intelligence at cryptocurrency research firm Messari, said: “I think we will see an acceleration of companies looking to allocate to bitcoin now that Tesla has made the first move.

“One of the largest companies in the world now owns bitcoin, and by extension, every investor that owns Tesla (or even just at S&P 500 fund) has exposure to it as well.”

‘Stick to electric cars’

While soaring bitcoin share prices mean big returns for Tesla, Musk’s enthusiasm for the digital currency also brings “more immediate risks”, of which “one is to Tesla’s reported profitability”, says the FT.

Pointing to these risks, The Guardian’s Nils Pratley argues that Tesla should stick to what the firm is good at: “electric cars, energy-storing batteries and so on. Leave punting on bitcoin to the devotees.”

Meanwhile, Bloomberg’s Liam Denning says that Musk’s “preoccupation with crypto has now been taken to its logical conclusion”.

Denning writes that “having witnessed Gamestonk” - a reference to the recent GameStop trading frenzy drama - “we surely all knew that this Venn diagram eclipse of the most speculative car company in the world and the most speculative ‘currency’ in the world was coming.

“Tesla sells stock because it can and then uses some of the proceeds to buy Bitcoin because it can. It’s as simple, and disconcerting, as that.”

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Mike Starling is the former digital features editor at The Week. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.

-

Starlink: what Elon Musk's satellite soft power means for the world

Starlink: what Elon Musk's satellite soft power means for the worldThe Explainer The rapid expansion of his satellite internet company has given Musk a unique form of leverage in some of the world's most vulnerable regions

-

Lilo & Stitch: is Disney's latest live-action remake a 'ghastly misfire'?

Lilo & Stitch: is Disney's latest live-action remake a 'ghastly misfire'?Talking Point The studio's retelling of the 2002 original flattens its fuzzy blue protagonist – but could still be a box office smash

-

A manga predicting a natural disaster is affecting tourism to Japan

A manga predicting a natural disaster is affecting tourism to JapanUnder the Radar The 1999 book originally warned of a disaster that would befall Japan in 2011 — a prophecy that came true

-

Crypto firm Coinbase hacked, faces SEC scrutiny

Crypto firm Coinbase hacked, faces SEC scrutinySpeed Read The Securities and Exchange Commission has also been investigating whether Coinbase misstated its user numbers in past disclosures

-

How could Tesla replace Elon Musk?

How could Tesla replace Elon Musk?Today's Big Question The company's CEO is its 'greatest asset and gravest risk'

-

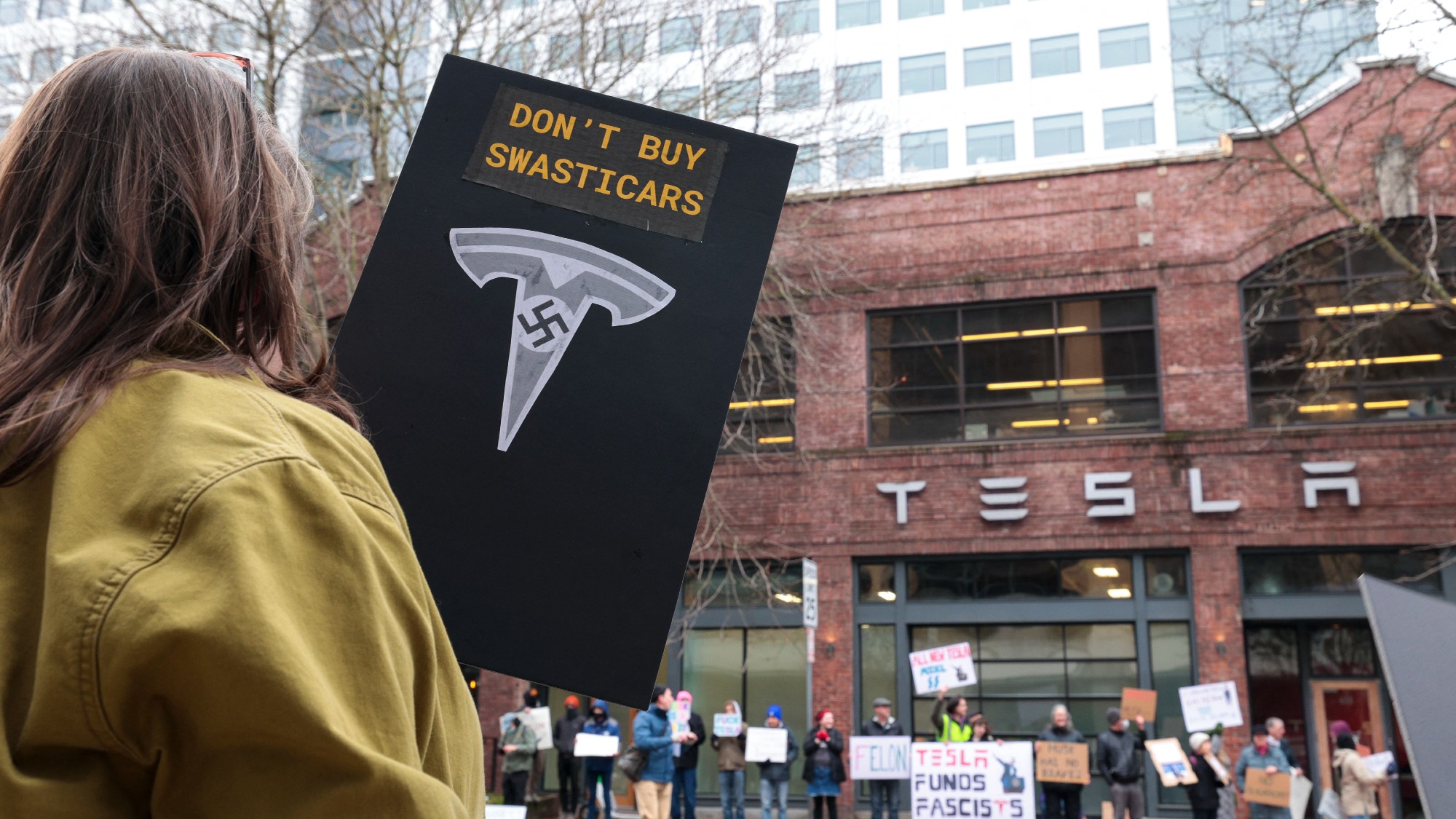

Elon Musk: has he made Tesla toxic?

Elon Musk: has he made Tesla toxic?Talking Point Musk's political antics have given him the 'reverse Midas touch' when it comes to his EV empire

-

What does Musk's 'Dexit' from Delaware mean for the future of US business?

What does Musk's 'Dexit' from Delaware mean for the future of US business?Talking Points A 'billionaires' bill' could limit shareholder lawsuits

-

Tesla Cybertrucks recalled over dislodging panels

Tesla Cybertrucks recalled over dislodging panelsSpeed Read Almost every Cybertruck in the US has been recalled over a stainless steel panel that could fall off

-

Texas vs. Delaware: See you in court

Texas vs. Delaware: See you in courtFeature Delaware risks losing its corporate dominance as companies like Tesla and Meta consider reincorporating in Texas

-

The collapse of El Salvador's bitcoin dream

The collapse of El Salvador's bitcoin dreamUnder the Radar Central American nation rolls back its controversial, world-first cryptocurrency laws

-

Javier Milei's memecoin scandal

Javier Milei's memecoin scandalUnder The Radar Argentinian president is facing impeachment calls and fraud accusations