The great reopening

Spirits are high as consumers are unleashed, but recovery depends on other factors too

Forget the start of grouse shooting in August; for Britain’s small businesses, the “Glorious Twelfth” arrived early on 12 April with the long-anticipated reopening of pubs, shops, salons and restaurants, said Jayna Rana on ThisIsMoney.co.uk. The mood was upbeat. The Federation of Small Businesses reported that confidence is at its highest level since 2014, thanks to the perceived “certainty” provided by the Government’s roadmap. After three months of “being deprived of a retail fix”, shoppers were out in force, said Larry Elliott in The Guardian. Economists say it’s “unwise to read too much into one month’s data”, let alone “one day’s footfall”, but the first signs were encouraging. Nonetheless, footfall was still down on the same day two years ago – “a long-lost time of innocence when pandemics, mass vaccination programmes and needing face masks to enter shops were the stuff of sci-fi movies”.

The pandemic-induced gaps on the high street told their own story, said The Observer. Among them are the entire Arcadia empire, Oasis and Warehouse, Cath Kidston, Thorntons and several John Lewis outlets. Poignantly, the collapsed department store chain Debenhams reopened its doors, “but only for a closing-down sale”. A similar picture looked to be forming in the hospitality trade, said Simon Read on BBC Business. Only two in five pubs in England reopened on Monday. “No pub is expecting to profit from reopening outdoors, and many will make a loss,” noted Emma McClarkin of the British Beer & Pub Association. And some 2,500 pubs are estimated to have closed for good in 2020.

Many consumer-facing businesses are banking on a “spend, spend, spend” mentality as Britons unleash their lockdown savings, said Russell Lynch in The Daily Telegraph. The “Eeyorish counterpoint” to that is grounded in behavioural economics: “we mentally create different ‘pots’ of money” and this determines our willingness to spend. “My suspicion is that savings will be treated as assets and deployed cautiously.” For my money, “a consumer upturn is not in doubt, barring unexpected Covid developments”, said David Smith in The Times. But trade and investment are also “essential ingredients for a balanced economic recovery” and recovery there is much more doubtful. With EU and world trade still depressed, “forecasters are unanimous” in expecting UK net trade (exports minus imports) to deduct from this year’s GDP growth. And the Resolution Foundation warns against expecting too much of business investment, as so many companies “have taken on too much debt”. British consumers are “a tribe you write off at your peril”, but they cannot spend us out of this pandemic on their own.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

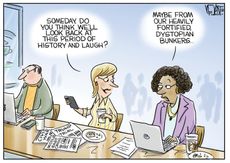

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published