Could Saudi Arabia weaponise oil again?

Gulf kingdom responds to sanctions threat by evoking memories of the 1973 oil crisis

Saudi Arabia has threatened to use its oil supplies to retaliate against any sanctions by the West over the death of Jamal Khashoggi, rekindling memories of the 1973 oil crisis which marked a defining shift in the post-war balance of global power.

The latest Saudi explanation for the death - that the dissident journalist died in its Istanbul embassy as a result of a fist fight - has met with scepticism in the west. US President Donald Trump has said the consequences could be “very severe” if the government in Riyadh is found to have ordered the killing.

The Saudis have responded by threatening a cut in global oil supplies which could push crude prices back up well above $100 a barrel.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It is a threat that brings back memories of 1973 when oil producing states held the West to ransom by quadrupling prices almost overnight, a move which had huge and wide-reaching ramifications for the global economy.

Writing in a personal capacity, Turki Aldakhil, general manager of the state-owned Al-Arabiya news channel, warned yesterday that the United States would “stab its own economy to death” and oil prices would soar to $200 a barrel if Washington imposes sanctions on Riyadh.

With the Trump administration already calling on Opec to bring down oil prices as its sanctions against Iran begin to take effect and with crucial mid-term elections less than a month away, “such an oil shock would come at a very sensitive time” says CNN Business.

However, there is debate about whether Saudi threats to hike the price of oil still carry the same conviction they did in the 1970s.

World oil markets have been transformed by a doubling in American output over the past decade, meaning America and the West have become much less reliant on oil from the Middle East.

According to the US Energy Information Administration, the United States imports just 9% of its oil from the Gulf kingdom, and import from Saudi Arabia have halved in 25 years.

An economy still overly-reliant on oil revenue, growing unemployment among a predominantly young population and a need to diversify “means, simply, that the country with most to lose from a sharp rise in oil prices would be Saudi Arabia itself” says Larry Elliott in The Guardian, calling Saudi threats “a gigantic bluff”.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

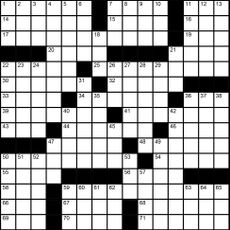

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine printables - May 3, 2024

Magazine printables - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

How would we know if World War Three had started?

How would we know if World War Three had started?Today's Big Question With conflicts in Ukraine, Middle East, Africa and Asia-Pacific, the 'spark' that could ignite all-out war 'already exists'

By Harriet Marsden, The Week UK Published

-

The issue of women and conscription

The issue of women and conscriptionUnder the radar Ukraine military adviser hints at widening draft to women, as other countries weigh defence options amid global insecurity

By Harriet Marsden, The Week UK Published

-

Ukraine's unconventional approach to reconstruction

Ukraine's unconventional approach to reconstructionUnder the radar Digitally savvy nation uses popular app to file compensation claims, access funds and rebuild destroyed homes

By Harriet Marsden, The Week UK Published

-

Will Ukraine's leadership reset work?

Will Ukraine's leadership reset work?Today's Big Question Zelenskyy hints at ousting of popular military chief, but risks backlash amid dwindling munitions, delayed funding and Russian bombardment

By Harriet Marsden, The Week UK Published

-

Imran Khan sentenced to 10 years: how powerful is Pakistan's military?

Imran Khan sentenced to 10 years: how powerful is Pakistan's military?Today's Big Question The country's armed forces ignore country's economic woes, control its institutions and, critics say, engineer election results

By Harriet Marsden, The Week UK Published

-

What is Iran's endgame?

What is Iran's endgame?Today's Big Question Tehran seeks to supplant US and Saudi Arabia as dominant power in Middle East while forcing Israel to end Gaza war

By Harriet Marsden, The Week UK Published

-

Israel proposes two-month pause in Gaza war in exchange for all Hamas hostages

Israel proposes two-month pause in Gaza war in exchange for all Hamas hostagesSpeed Read Deal doesn't include an agreement to end war, but might be 'the only path that could lead to a ceasefire', said US officials

By Harriet Marsden, The Week UK Published

-

Nato official warns of all-out war with Russia in next 20 years

Nato official warns of all-out war with Russia in next 20 yearsSpeed Read Civilians must prepare for life-changing conflict and mass mobilisation, says military chief

By Harriet Marsden, The Week UK Published