UK businesses call for 2008-style ‘no deal’ Brexit bailout

Firms calls for state bailout similar to the financial crisis in order avoid wide-scale bankruptcies

British businesses have called for a 2008-style government bailout to avoid wide-scale bankruptcies in the event of a catastrophic no-deal Brexit.

With Theresa May’s Brexit plans hanging by a thread, the next 36 hours are seen as crucial for the negotiations.

Yet even if a deal agreed in principle can be sealed between the Cabinet and Brussels this week, it is far from certain that any agreement will be ratified by MPs in Westminster, meaning the UK could still leave with no deal at all, even though many among the business community say it is already too late to prepare adequately for it.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Speaking to Politico’s Charlie Cooper, Ian Wright, chief executive of the Food and Drink Federation, said “if the UK does fall over the Brexit cliff edge, ministers must leverage the government’s “financial muscle … in rather the way they did for the banks during the [2008] crash.”

“If the government was to say no [to that] now there would be a very big question from British industry: ‘You were prepared to fund the banks who brought the crisis on themselves… but you’re not prepared to support British business which is completely innocent of any fault in the current circumstances?’”

Despite repeated warnings about supply-chains, stockpiling and wide-spread disruption, the Institute of Directors, which represents business leaders, estimates only a third of its more than 30,000 members have done contingency planning for a no-deal Brexit.

While the consequences of a no-deal Brexit for the country as a whole have been widely report, not least in more than 100 “technical notices” published by the government over the summer, the impact on small and medium-sized businesses has received little attention.

The IoD’s Allie Renison said: “As long as it remains government policy to potentially walk away, it is incumbent on them to make further provision to help firms be fully ready for the consequences of that outcome.”

In the government's absence, banks and private financial intuitions stepped in to fill the void.

The Financial Times has reported that UK banks have been making practical preparations, including the setting up of new continental European subsidiaries or transferring operations.

Royal Bank of Scotland announced last month is has set aside £2 billion in funding to help SMEs deal with Brexit.

RBS said the cash would be used to provide services such as trade finance, term finance and increased liquidity for small businesses which rely on EU labour markets or exposure to foreign exchange movements.

With huge investment needed in staff, IT systems or outsourcing but continuing uncertainty about whether there will or won’t be a deal, Politico says “many have gambled on there being a deal rather than make an investment they can ill-afford”.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

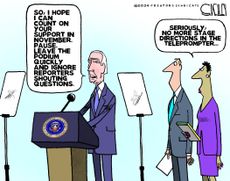

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

Why au pairs might become a thing of the past

Why au pairs might become a thing of the pastUnder The Radar Brexit and wage ruling are threatening the 'mutually beneficial arrangement'

By Chas Newkey-Burden, The Week UK Published

-

Brexit: where we are four years on

Brexit: where we are four years onThe Explainer Questions around immigration, trade and Northern Ireland remain as 'divisive as ever'

By The Week UK Published

-

Is it time for Britons to accept they are poorer?

Is it time for Britons to accept they are poorer?Today's Big Question Remark from Bank of England’s Huw Pill condemned as ‘tin-eared’

By Chas Newkey-Burden Published

-

Is Brexit to blame for the current financial crisis?

Is Brexit to blame for the current financial crisis?Talking Point Some economists say leaving the EU is behind Britain’s worsening finances but others question the data

By The Week Staff Published

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

By The Week Staff Published

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

By The Week Staff Published

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

By The Week Staff Last updated

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

By The Week Staff Published