The house price boom in five charts

Demand continues to outstrip ‘stock-starved’ housing market

Lockdowns and the largest fall in GDP for 300 years failed to slow the UK’s housing market over the past year.

In spite of the turbulent financial backdrop, “house prices appear to have defied economic gravity”, said The Guardian. And this has been “the year of the power buyer”, according to Rightmove’s director of property data Tim Bannister.

“Those in the most powerful position to proceed quickly and with most certainty” are “ruling the roost over other buyers”, he said. Meanwhile, buyers without a sale of their own home secured are “being out-muscled by buyers who have already sold subject to contract”, Bannister added.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And the changes in buying trends initially seen as a result of coronavirus restrictions have continued. “With hybrid working establishing itself as a fixture of post-pandemic working life,” said Peter Beaumont, chief executive of The Mortgage Lender, in the Evening Standard, “the race for space rolls on.”

But what’s really been driving the housing market for the past 30 years is “cheap money”, said The Spectator’s Ross Clark. “We have not had a prolonged period of rising interest rates in all that time,” and, as a result, “prices are really no higher than they were three decades ago”.

“Just what would finally bring the seemingly endless boom in house prices to a halt?” asks Clark. “Surely” it would be a period of rising interest rates, and with some estimating inflation will rise to 6% next year, “it is easy to argue the era of cheap money really ought to be at an end”.

“It is possible to imagine scenarios whereby inflation becomes more sustained,” said University College London economist Josh Ryan-Collins writing in The Guardian. But an interest rate rise to 2% “could still have damaging impacts on the economy”. How, asked Ryan-Collins, “did we end up in a situation where small rises in interest rates… could raise such serious concerns for the macroeconomy?”.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

No. 10 is “so scared of the chaos that a housing bust would unleash that it is unlikely to let it happen,” said MoneyWeek.

Raising interest rates could “detonate the housing market bomb” that’s “planted” beneath the economy, said Clark. “Don’t expect the government to sit idly by”; surely it will “come up with wheezes” to keep the housing market afloat, he said.

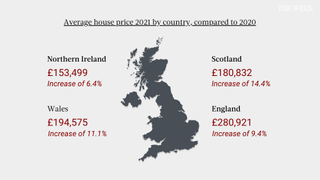

Costs by country

Average property prices across the UK have hit a record high of £338,462 according to data collated by Rightmove. But the new average – a 0.3% increase on last month’s figures – is only £15 higher than that reported in July this year, with prices finally showing signs of stabilising.

“Stamp duty breaks and a rush for larger homes” has fuelled the rise in house prices, said The Guardian, with every country in the UK seeing a significant annual increase.

The tax holiday may now be over, but demand hasn’t slowed. The market is “stock-starved”, said Bannister, and the competition between buyers is fierce, at “double what it was this time in 2019”.

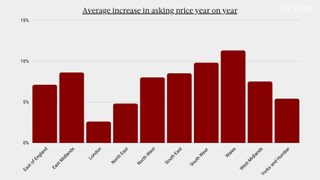

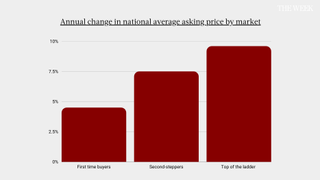

Asking prices

The average increase in property prices across the UK during the past 12 months has been lowest in London, “a pattern that has been seen since the coronavirus hit, with buyers increasingly looking for more space after months of confinement in their homes”, said Bloomberg.

In Wales, some areas are seeing “unprecedented” rises in house prices, said Wales Online. It’s not the case that second home owners are “pricing out longstanding residents”, which had been “initially seen” as the pandemic eased.

Now, estate agents say people are hunting out family homes “in nice places” and they are “willing to pay for it”.

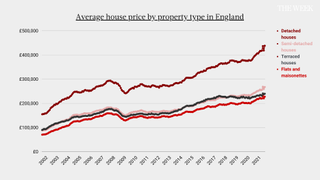

Price tag by house type

Asking prices have increased across all types of properties on the market, but detached and semi-detached peroperties will set buyers back the most.

Despite buyer interest in flats falling at the start of the pandemic, Rightmove reported an increase in demand for smaller properties in urban locations between January and April this year.

“There has been no big exodus of office workers liberating from a life of community,” according to research published by the London School of Economics in March, said the Financial Times. The demand for detached houses with gardens is a “long term trend”, and properties between 20 and 40km from central London have continued to increase in price.

The “long-term outlook for cities is good” too, but a less restrictive planning system is needed to avoid a scenario where housing remains “unaffordable and increasingly so”, said LSE’s researchers.

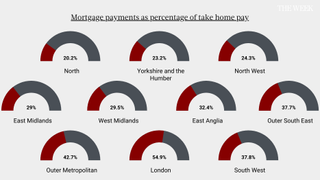

True cost of mortgages

It’s widely recommended that homeowners spend no more than 28% of their take-home pay on mortgage repayments and housing expenses. Ticking that box “makes you a competitive buyer”, said Business Insider.

Londoners are spending the most on their mortgages, according to Nationwide’s data – over half of their take-home pay, on average. Homeowners in the north of England are parting with less than half the amount of disposable income than those in the capital.

The south is generally a pricier market, but the averages in the Midlands also creep just over the 28% recommendation.

Market rises

Estate agents have seen first time buyers “priced out” of the property market in the past year, the Evening Standard said, though the government’s 95% mortgage guarantee scheme helped some to get their foot on the ladder.

However, those eligible for the scheme do face some risks. “A small fall in the value of the home could mean that you are in negative equity,” making it difficult to move home or secure another fixed-interest loan, said The Observer.

Create an account with the same email registered to your subscription to unlock access.

Julia O'Driscoll is the engagement editor. She covers UK and world news, as well as writing lifestyle and travel features. She regularly appears on “The Week Unwrapped” podcast, and hosted The Week's short-form documentary podcast, “The Overview”. Julia was previously the content and social media editor at sustainability consultancy Eco-Age, where she interviewed prominent voices in sustainable fashion and climate movements. She has a master's in liberal arts from Bristol University, and spent a year studying at Charles University in Prague.

-

Who actually needs life insurance?

Who actually needs life insurance?The Explainer If you have kids or are worried about passing on debt, the added security may be worth it

By Becca Stanek, The Week US Published

-

Sexual wellness trends to know, from products and therapies to retreats and hotels

Sexual wellness trends to know, from products and therapies to retreats and hotelsThe Week Recommends Talking about pleasure and sexual health is becoming less taboo

By Theara Coleman, The Week US Published

-

Is the AI bubble deflating?

Is the AI bubble deflating?Today's Big Question Growing skepticism and high costs prompt reconsideration

By Joel Mathis, The Week US Published

-

House prices fall at fastest pace since 2009 – and more pain expected

House prices fall at fastest pace since 2009 – and more pain expectedSpeed Read Gloomy forecasts follow 4.6% year-on-year drop as higher interest rates hit the property market

By Chas Newkey-Burden Published

-

The pros and cons of new-builds

The pros and cons of new-buildsPros and Cons More options for first-time buyers and lower bills are offset by ‘new-build premium’ and the chance of delays

By The Week Staff Published

-

Pros and cons of shared ownership

Pros and cons of shared ownershipPros and Cons Government-backed scheme can help first-time buyers on to the property ladder but has risks

By The Week Staff Published

-

Rental prices in London: the cheapest and most expensive boroughs

Rental prices in London: the cheapest and most expensive boroughsfeature Costs are soaring as people return to the capital after the Covid pandemic

By The Week Staff Published

-

Affordability test scrapped: what ‘huge’ mortgage rule change means for buying a house

Affordability test scrapped: what ‘huge’ mortgage rule change means for buying a houseTalking Point Bank of England cuts red tape on mortgage approval process despite soaring inflation

By The Week Staff Published

-

Is the UK about to see ‘biggest ever’ house price crash?

Is the UK about to see ‘biggest ever’ house price crash?In Depth House prices have risen for fourth month in a row but it remains a 'buyers' market

By Rebekah Evans, The Week UK Last updated

-

‘Weakest since 2012’: UK house price average falls to £257,406

‘Weakest since 2012’: UK house price average falls to £257,406In Depth Prices down 1.1% year-on-year in February – the first annual decline since June 2020

By The Week Staff Last updated

-

UK house prices in 2022: what the experts think

UK house prices in 2022: what the experts thinkfeature Sellers’ market, what next and mortgage matters

By The Week Staff Published