Help to Buy Isas revealed in Budget: how do they work?

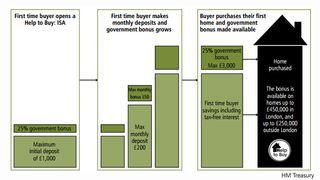

Osborne says Help to Buy Isas will give first-time buyers a 25% top-up on their savings, but there's a catch

George Osborne has revealed a new Help to Buy Isa, designed to help first-time home buyers save for a deposit.

In his Budget speech, the Chancellor said he wanted to tackle two of the biggest challenges facing first-time buyers: low interest rates for savings and high deposits required by banks for mortgage loans.

To do this, the government has pledged to give buyers a 25 per cent top-up on their savings. "It's as simple as this – we'll work hand in hand to help you buy your first home," he said.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For every £200 an individual saves for their deposit, the government says it will top it up with £50 more.

"A ten per cent deposit on the average first home costs £15,000, so if you put in up to £12,000 – we'll put in up to £3,000 more," said Osborne.

However, there are a few limitations, the most significant of which appears to be a cap on the amount that savers can pay into the account each month.

The maximum initial deposit is £1,000, while the maximum monthly deposit is £200. This means a first-time buyer would have to pay into the Isa for more than four years in order to receive the government's maximum bonus of £3,000. (Click on the image below to expand)

On the plus side, accounts are limited to one per person rather than one per household, so a co-habiting couple saving for a house can receive the bonus twice.

The accounts are only available to individuals who are at least 16 years old and it will only be paid at the point when the person uses their savings to purchase their first home.

"Savers will have access to their own money and will be able to withdraw funds from their account if they need them for another purpose but the bonus will only be made available for home purchase," states the Budget.

The bonus will also only be available on home purchases of up to £450,000 in London and up to £250,000 outside London. According to the Treasury, the accounts will be available through banks and building societies from autumn 2015.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published

-

Will Aukus pact survive a second Trump presidency?

Will Aukus pact survive a second Trump presidency?Today's Big Question US, UK and Australia seek to expand 'game-changer' defence partnership ahead of Republican's possible return to White House

By Sorcha Bradley, The Week UK Published

-

It's the economy, Sunak: has 'Rishession' halted Tory fightback?

It's the economy, Sunak: has 'Rishession' halted Tory fightback?Today's Big Question PM's pledge to deliver economic growth is 'in tatters' as stagnation and falling living standards threaten Tory election wipeout

By Harriet Marsden, The Week UK Published

-

Why your local council may be going bust

Why your local council may be going bustThe Explainer Across England, local councils are suffering from grave financial problems

By The Week UK Published

-

Rishi Sunak and the right-wing press: heading for divorce?

Rishi Sunak and the right-wing press: heading for divorce?Talking Point The Telegraph launches 'assault' on PM just as many Tory MPs are contemplating losing their seats

By Keumars Afifi-Sabet, The Week UK Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

How the biggest election year in history might play out

How the biggest election year in history might play outThe Explainer Votes in world's biggest democracies, as well as its most 'despotic' and 'stressed' countries, face threats of violence and suppression

By Harriet Marsden, The Week UK Published

-

'Good democracies include their poorest citizens. The UK excludes them'

'Good democracies include their poorest citizens. The UK excludes them'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published