Can best M&S results for two years save boss Marc Bolland?

'Jekyll and Hyde' retailer buoyed by food sales but analysts warn that CEO's 'judgement day' will come

MARKS & SPENCER posted its best performance for two years in the first quarter of 2013, defying analysts who had predicted a slump and easing pressure on the firm's beleaguered chief executive Marc Bolland.

While sales in the company's clothing-dominated general merchandising section fell for the seventh quarter in a row, by 3.8 per cent, the decline was offset by a 4 per cent increase in sales of food in the run-up to Easter. This led to an overall increase of 0.6 per cent in like-for-like sales.

The contrast in each division's success led the Daily Telegraph to describe the chain as having a "Jekyll and Hyde personality". However, it points out that food sales were boosted last quarter because "it included New Year's Eve and Easter, when the same quarter in 2012 did not".

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

While the better-than-expected results will ease some pressure on the company's chief executive Marc Bolland, the Financial Times says shareholders have serious concerns about the retailer's performance.

Ahead of today's results, one shareholder said if the company was still "struggling" ahead of its annual general meeting this summer then "there might be a big protest vote that would put a lot of pressure on the chief executive". M&S is expected to report a loss in annual profits for the second year in a row in May but shares in the business rose immediately after the results were posted today.

Bolland has previously urged investors to wait for the improved autumn/winter 2013 collection to emerge, after he brought in former Jaeger boss Belinda Earl to help revive the womenswear department.

James McGregor, director of the consultancy Retail Remedy told The Guardian that "judgement day" for Bolland will not come until the end of the year. "The buying decisions of the new general merchandise team cannot be assessed until autumn-winter 2013, and the success of the collections they put in store will either save the chief executive or be the final nail in his coffin."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

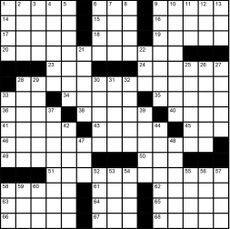

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

M&S to shut flagship Oxford Street store if demolition refused

M&S to shut flagship Oxford Street store if demolition refusedSpeed Read Retailer warns that key shopping street has ‘smell’ of ‘decline’

By The Week Staff Published

-

Fresh blow for Marks & Spencer as finance boss quits

Fresh blow for Marks & Spencer as finance boss quitsSpeed Read Humphrey Singer had been in the job for little more than a year

By The Week Staff Last updated

-

Why M&S is about to drop out of FTSE 100

Why M&S is about to drop out of FTSE 100In Depth Struggling high-street stalwart loses its place among the UK’s top 100 companies

By James Ashford Published

-

Could M&S lose its high street crown?

Could M&S lose its high street crown?Speed Read Retailer to shut 100 stores by 2022 after years of declining sales

By The Week Staff Last updated

-

Poundland's Toblerone war: What are the best own-brand products?

Poundland's Toblerone war: What are the best own-brand products?In Depth Even better than the real thing? Here are six store products to put in your trolley

By The Week Staff Published

-

Marks & Spencer shares fall as sales dip across the board

Marks & Spencer shares fall as sales dip across the boardIn Depth Clothing decline slows, but like-for-like food sales drop into the red

By The Week Staff Last updated

-

Sainsbury's sales rise but Lidl and Aldi 'win Christmas battle'

Sainsbury's sales rise but Lidl and Aldi 'win Christmas battle'In Depth Supermarkets report record sales for the Christmas period, with winners at both ends of the market

By The Week Staff Published