Making money: what the experts think

Burryed alive, feeling peaky and stalling house prices

Burryed alive?

Michael Burry rose to fame when his bets against mortgage securities during the 2007-08 financial crisis were featured in the movie The Big Short. Now he has a new target, said Bloomberg. Burry’s fund, Scion Asset Management, “has taken aim at one of Wall Street’s hottest stars”: Cathie Wood, whose flagship exchange-traded fund, the ARK Innovation ETF, has lured in billions from investors since “her thematic tech-focused bets trounced the market in 2020”. Scion isn’t alone. Several other hedge funds have amassed big short positions. Wood may have her critics, but she was “ahead of many peers” in “paring” Chinese tech holdings during the country’s recent crackdown. And she’s not afraid of taking on Burry – observing on Twitter that while he made “a great call” in the mortgage market, he doesn’t really understand “the fundamentals that are creating explosive growth and investment opportunities in the innovation space”.

Feeling peaky

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In fact, fund managers globally are signalling “peak boom” and “peak risk”, said Jeremy Gordon on Citywire. But that doesn’t mean they’re selling shares. According to Bank of America Merrill Lynch’s latest survey, optimism about the global economic recovery has plummeted, with just 27% of respondents expecting continued improvement – down from a peak of 91% in March. There’s “growing consensus that the rebound in corporate profitability is set to move into reverse”, and that “monetary authorities will start to reduce stimulus”. But while bond yields are “anchored near record lows”, investors see no choice but to remain “loaded up with equities”.

Stalling house prices

“The long surge northwards in UK house prices” may have peaked too, said Investors Chronicle. According to online estate agency Rightmove, the average price of houses coming onto the market has dipped by 0.3% (or about £1,000) so far in August and now stands at £337,371. “Summer is traditionally a quieter time for the market but, until now, there had been little sign of house price growth abating.” It appears that the end of the stamp duty holiday for houses priced above £500,000 – and the “impending removal” of the tax break for houses above £250,000 – may finally be having an effect.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

'Horror stories of women having to carry nonviable fetuses'

'Horror stories of women having to carry nonviable fetuses'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Haiti interim council, prime minister sworn in

Haiti interim council, prime minister sworn inSpeed Read Prime Minister Ariel Henry resigns amid surging gang violence

By Peter Weber, The Week US Published

-

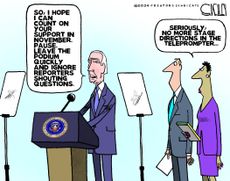

Today's political cartoons - April 26, 2024

Today's political cartoons - April 26, 2024Cartoons Friday's cartoons - teleprompter troubles, presidential immunity, and more

By The Week US Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published

-

Currency: the long reign of the mighty dollar

Currency: the long reign of the mighty dollarFeature Argentina is planning to drop the peso in favor of the US dollar

By The Week US Published