Investing in Asia: what the experts think

China Plus One, Viet opportunity and India’s stealthy bull

China Plus One

When the pandemic hit, many “wrote an obituary for China-focused globalisation”, said Megan Greene of Harvard Kennedy School in the FT. But there’s actually little evidence of it slowing down. US imports hit “an all-time high” of $288.5bn in September, and China’s trade surplus has exceeded pre-pandemic levels. True, we don’t know how the geopolitics will “play out”. But what seems more likely than deglobalisation is the developing “China Plus One” strategy: companies keeping factories in China, but hedging their bets elsewhere. Foreign direct investment (FDI) has thus been growing fast in Thailand, Vietnam and Malaysia – spelling opportunities for investors.

Viet opportunity

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The market that catches my eye, said Jeff Prestridge in The Mail on Sunday, is Vietnam – a comparatively new Asian tiger, which enjoyed pre-pandemic growth of 7-8%, and seems “set for a big leap”. The Vietnamese stock market is among Asia’s best performing – up more than 30% this year. More of the same is predicted for 2022 as corporate earnings recover – particularly if, as seems likely, Vietnam is reclassified from an embryonic “frontiers” market to a fully- fledged “emerging” market, which will attract the big international investors. Three trusts trading on the London Stock Exchange invest exclusively in Vietnamese companies: VinaCapital Vietnam Opportunity, Vietnam Holding and Vietnam Enterprise. But they’re only for “brave hearts”. A safer bet, says Brian Dennehy of Fund Expert, is a fund broadly invested across Asia, such as Barings ASEAN Frontiers, which has 2.5% of its assets in Vietnam.

India’s stealthy bull

Don’t forget India, said Rob Morgan of Charles Stanley in Investment Week. Thanks to a “stealth” bull market, the country’s main Sensex index is up by almost 50% over one year. Shares are now expensive, but India “remains unique among major economies” for its scope for fast growth: predicted at 9% this year, and around 6% in 2022. The country is increasingly seen “as a natural alternative to China” for outsourcing manufacturing. If you’re looking for “broad exposure to Asia”, with a significant Indian exposure, consider the Stewart Investors Asia Pacific Sustainability fund, which has around 40% of its portfolio in Indian equities.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

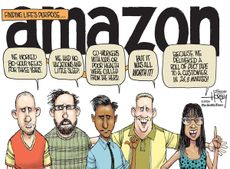

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published

-

Shein: could the year’s mega-IPO fall apart at the seams?

Shein: could the year’s mega-IPO fall apart at the seams?Talking Point Latest hitch is a pre-float 'security review' that could deter potential investors

By The Week UK Published

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

By The Week US Published

-

Midair blowout: another black mark for Boeing

Midair blowout: another black mark for BoeingFeature This isn't the first production issue Boeing has encountered

By The Week US Published

-

Behemoths of the seas

Behemoths of the seasThe Explainer Cruise liners keep getting bigger, with the world’s largest 'megaship' ever built set to make its maiden voyage this month.

By The Week Staff Published

-

Holiday season: Fed optimism cheers investors

Holiday season: Fed optimism cheers investorsFeature The feds believe their 'pivot' will make a recession unlikely

By The Week US Published

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

By The Week Staff Published

-

America's most in-demand job

America's most in-demand jobFeature And more of the week's best financial insight

By The Week US Published

-

Currency: the long reign of the mighty dollar

Currency: the long reign of the mighty dollarFeature Argentina is planning to drop the peso in favor of the US dollar

By The Week US Published